Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

One of the reasons I started this blog was to educate others and to improve my own investing. This is why I like to keep my readers up to date on my portfolio changes. By keeping an open book of my portfolio and changes to it, I hope to generate discussion so others can see how I put my investing philosophy into practice. For the most up to date portfolio changes follow my twitter account as I will usually tweet first and then follow-up with a blog post.

Bank of Nova Scotia

On August 24, 2015 I averaged down and purchased Bank of Nova Scotia [TSE:BNS Trend] for $55.04 plus the commission. I first bought Bank of Nova Scotia on July 27, 2015 for $62 + commission. With this second purchase my average cost is now $59.54. I’m not going to go into too much detail here as I’ve already written a dividend stock analysis and updated my valuation and reasonably cheap target for Bank of Nova Scotia in another portfolio update article. My main reasons for buying Bank of Nova Scotia were its wide moat, high yield, long history of dividend growth, reasonable payout ratio and the fact that it was trading at a reasonably cheap price.

Bank of Nova Scotia is one of the big 6 Canadian Banks. They have increased dividends in 43 of the last 45 years and have a current dividend streak of 4 years. Bank of Nova Scotia has 5 and 10 year annual dividend growth rates of 5.5% and 8.8% respectively. Since my purchase they increased the quarterly dividend from $0.68 to $0.70 which was the second 2 cent raise in the past year. Based on its current price of $60.20 it has a historically high dividend yield of 4.7%. When I see a stock like Bank of Nova Scotia get cheaper after my initial purchase, I’m happy to buy more. That said, my portfolio is getting heavy on financials so I’m going to try and limit future purchases to nibbles in this sector. I’m also not sure if I’ll be adding new financial positions to the portfolio in the near to mid-term.

Caterpillar

On August 24, 2015 I purchased Caterpillar [NYSE:CAT Trend] for $72.00 + commission. The price of CAT continued to fall, so I purchased more shares on September 29, 2015 for $64.48 + commission. My average cost is $69.43.

Related article: Caterpillar Inc. Dividend Stock Analysis

Caterpillar Inc. is a wide moat company that manufacturers construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. Caterpillar currently yields a historically high dividend yield of 4.4% and has 5 and 10 year annual dividend growth rates of 9.1% and 12.8% respectively. Their most recent dividend increase was 10% when they upped the quarterly dividend from $0.70 to $0.77. Below is a 5 year chart of their 5 year trailing-twelve-month (TTM) yield. Based on dividend yield over the past 5 years it looks like the company is trading at a cheap valuation. At the height of the financial crisis in 2009 the dividend yield got as high as 7.7%. In 2008 it got up to 4.9%. These are the only two years in the past decade where the dividend yield has been higher than it is now.

Caterpillar has an impressive dividend streak with 22 years of annual consecutive dividend increases. They have paid a cash dividend every year since the company was formed and have paid a quarterly dividend since 1933.

The last time I checked Valueling; back in May 2015, they had a financial strength rating of A+ and estimated future dividend growth for the next 3-5 years at 6.5% annually. Morningstar rates them at A- for credit rating. Based on these the company appears to have good financial strength.

Caterpillar has had difficulty in recent years growing revenue, but this is an industrial stock that I expect to have slightly erratic sales and earnings. Over the long term; however, I expect earnings and sales to grow and fuel continued dividend growth.

Emerson Electric

On August 24, 2015 I purchased Emerson Electric [NYSE:EMR Trend] for $45.12 + commission. Emerson Electric is a wide moat company engaged in designing and supplying products and technology, and delivering engineering services and solutions in industrial, commercial and consumer markets. Emerson Electric has one of the best dividend streaks out there. For the past 58 consecutive years they have managed to increase their dividend annually. Yes 58 years, you read that right. This is the seventh longest streak in the US Dividend Champions list. American States Water [NYSE:AWR Trend] has the longest streak with 61 years, so Emerson Electric is only trailing by 3 years. This is quite impressive.

Emerson Electric currently yields a historically high dividend yield of 4.2% and has 5 and 10 year annual dividend growth rates of 5.8% and 8.1% respectively. They currently pay a quarterly dividend of $0.47 which I’d expect to be increased when they announce their next dividend likely in November. Last I looked (May 2015), Valueline was estimating future dividend growth at 6.0% annually for the next 3-5 years.

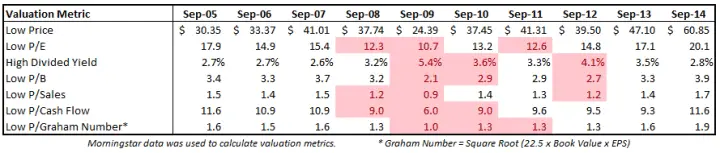

Below is a 10 year table of the lowest valuation metrics for each year for Emerson Electric. The three lowest valuations are highlighted in red. If you look at the dividend yield you can see that in the past decade the dividend yield was higher only in 2009 when it got up to 5.4%.

Currently Morningstar has an A+ credit rating for Emerson Electric and last I looked at Valueline, Emerson was rated A++ for financial strength. Overall a strong addition to my dividend growth portfolio.

Diversification

Up until now, I’ve mostly been buying energy and financial stocks, so I was happy to add to a new sector: Industrials. With my Caterpillar and Emerson Electric purchases I’m building a more balanced portfolio. My industrial allocation is currently about 10% which is about where I want it. I only own 13 stocks so as I continue the grow the portfolio these allocations will change with new additions and stock price fluctuations.

I also recently purchased Potash Corporation of Saskatchewan [TSE:POT Trend] and then averaged down with a second purchase. With Potash Corporation of Saskatchewan I get some exposure to the basic materials sector. I’ll talk more about these purchases in a future post. Overall I feel like I’m heading in the right direction as far as sector allocation, but I still have some work. For instance I don’t own anything in three sectors: Healthcare, Consumer Defensive, and Utilities. I don’t own any real estate stocks, but this is on purpose as I’m try to limit my stock exposure to this sector because my condo makes up a significant portion of my net worth. I also want to have at least 3 stocks in each sector.

Because I typically wait for a reasonably cheap price before I will invest, it limits my ability to diversify quickly. I won’t go out and buy a stock unless it appears reasonably cheap. If there are no high quality dividend growth stocks trading at low valuations in a sector then I can’t be easily diversified as I have to wait for better prices. At this point valuation is more important to me than diversification. As I continue to grow the portfolio I’m hoping that I’ll get to a more diversified point, but with my investing strategy this process could take another couple of years, maybe longer.

How do you handle diversification while building a portfolio? What do you think of my recent purchases of Bank of Nova Scotia, Caterpillar and Emerson Electric?

Photo credit: The Rocketeer / Foter / CC BY-NC-ND

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

Morning DGI;

Not to second guess you but personnally I am not buying in to the US stocks because of the exchange rate fluctuations. Will it go up? Or Down? If our CDN$ goes up you just lost some value. If it goes down you increased some. I saw this with JNJ which I bought at par and sold with a nice appreciation as well as a dip in the CDN$ value for a double whammy gain. I said to my self I woudl buy back in at $90. Well that came and went because our dollar was still on a downward slope. Those are my thoughts on buying US equities for now. Nothing against the companies, I just do nto want to pay the market and the exchange rate at the same time.

Divs jsut came in last week. I will probably purchase something today if it will go down a little for me. I am looking at CDN companies with some international exposure.

RICARDO

You have nerves of steel, and/or a very long time horizon to buy Caterpillar at this time, author. Yes, the dividend yield is attractive (but likely to become more so), and yes the company is a stalwart, but it has been on a downward trend for a long time now. I guess I am a market timer at heart, but I’d prefer to wait until CAT puts in a clear bottom, and then invest on the way up (from a technical point of view). From a fundamental point of view, flagging economies around the world are not positive for CAT, which gets most of its revenue outside the USA.

So, while I like the choice of company, why this particular timing?

.

I bought BNS (C$) and EMR as well as BP and T. I had U$ converted at 1.06-7 for winters down south so decided to put some into divi stocks. I already have U$ consumer and U$ healthcare and C$ banks but need to work on diversification too. I’m therefore also looking at POT (C$). Thanks for your insights!

Just wondering if it would make sense to hold US dividend stocks in a TFSA (after the RRSPs are maxed out). Over time, one could build up a significant account without the need to report the $100K foreign property requirement, as with non-registered accounts.

The 15% withholding tax on the dividends can be viewed like an ETF’s MER for the US stocks. (say, .5%/annum) The landscape of choosing quality US dividend growers is much larger than Canada’s plus the US portfolio could be transferred in-kind to the beneficiaries (ie children) upon death of the last surviving spouse (assuming the contribution room is available).

A discount broker that allows a US side account without forced conversions of US dividends to CDN would, of course, be required. I appreciate the exchange rate is a factor but over the long haul, it should all average out anyways.

Thanks kindly for any comments/advice.

It would make more sense to shuffle your portfolio around so that the US stocks are held in your RRSP and the TFSA just holds the Canadian side of the portfolio. There is no withholding on US dividends when the stock is held in an RRSP (but distributions by REITs and MLPs are apparently subject to withholding no matter where you hold them)

I think you are required to report $100,000 of foreign assets only where they are held in an account or trust located outside Canada. A TFSA at a Canadian brokerage holding US stocks would seem to be a Canadian holding.

This is directly from the CRA website on Form 1135:

10. Are shares of non-resident corporations held through a broker (Canadian or foreign) specified foreign property?

Yes. Shares of non-resident corporations are specified foreign property and should be reported, regardless of whether the shares are held through a broker.

This has been in place since 2013 and the fine for non- compliance is $2,500…

That’s good information. Thanks.

But the good news is funds held in any registered account is

exempt (RRSP, TFSA or LIF).

If I had $100,000 in life savings. Could I buy equal amounts of the big 5 banks. Collect or drop the dividends, get dividend hikes. And be able to sleep at night? After all the banks are the prototype of the classic dividend stock? Good yield, close to a oliolgolopy, government backed, moat that makes it hard to copy so why not life savings in all banks?

Not drop dividends. DRIP

Damm auto correct

CAT looks like a nice one to me – I disagree with the other commentor above. The chart is clearly from the bottom left to the top right!

Will they outperform the market? Hard to say – I think it’s an OK long term pick, but things may get tricky for the next recession…

Moneyahoy:

If I look at a daiiy price chart YTD, 1 year, 2 years and 3 years, CAT ends up lower than a 0% return for the period.

Did you Avg it down ?

Average down on what stock?

BNS

Hi Ak,

I haven’t bought any more BNS.TO since the two purchases I mentioned in this article (July 27, 2015 @ $62 and August 24, 2015 @ $55.04). At this point my portfolio has a high exposure to financials and I don’t really want it going much higher. I’ve currently got a small open order out for National Bank of Canada at $36, but after this I don’t plan on buying more financials as I need to focus on diversifying into other industries. I own more BNS than I do NA, so I’m more comfortable adding to the NA position to bring it up to a full position.

I repeat my comments made last October. All stocks (CAT, EMR, and BNS) are on the skids — since about June / July 2014. Why buy them now — even if they are excellent long-term stocks — when they will probably be cheaper later?

CAT in particular is dependent on — and therefore reflects — worldwide economic prosperity. Countries are not doing so well lately, and so the short-term prospects for CAT are not promising.

Put the stock(s) on a waiting list to be sure, but wait.

That’s a good approach for sure