Looking for reliable Canadian dividend income?

Use the Canadian Dividend All-Star List

Do you want a retirement portfolio that weathers recessions and pays predictable and growing dividends?

I can help you with that. Here’s what to do next.

1

Not sure where to find reliable dividend-paying stocks to support your retirement dream?

Use the Canadian Dividend All-Star List to limit your search to only the best. You’ll find a treasure trove of information on Canadian dividend-paying stocks that have dividend growth streaks ranging from 5 years to almost half a century! These companies not only pay dividends, but they have also been increasing them for years on end.

2

Worried about investing through recessions and dividend cuts?

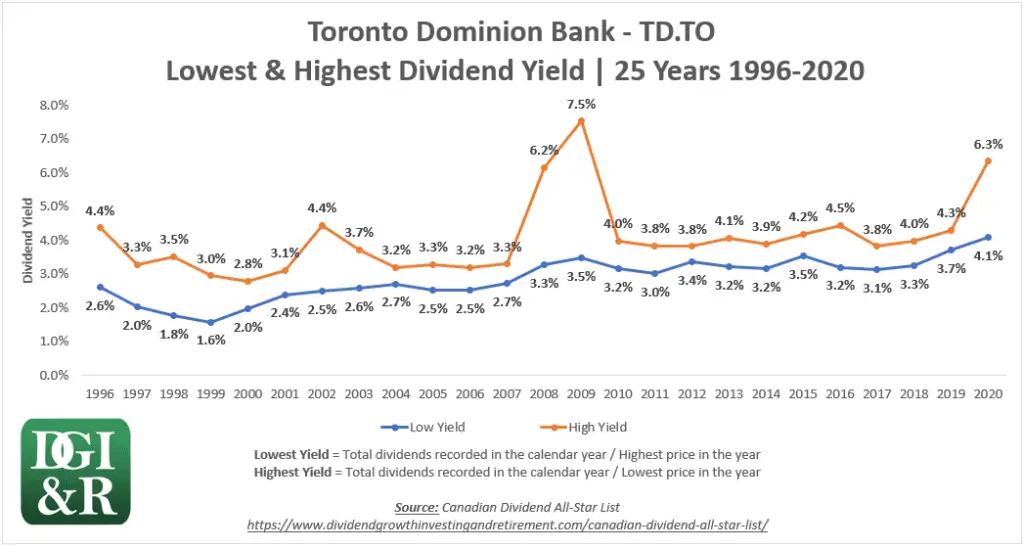

Read up on the resilience of Canadian dividend growth stocks and how they fared during the 2008/2009 global financial crisis and the 2020 COVID-19 global pandemic. Learn from my mistakes to better avoid dividend cuts.

3

Ready to dig deeper?

Watch our free videos on YouTube for examples on how to use the Canadian Dividend All-Star List to find high-quality dividend stocks.

Check out the blog and resources page to continue your investment journey.

Hi there, I’m DGI&R

I started this website because I was frustrated with the lack of coverage and data on Canadian dividend growth stocks.

I wanted a resource where I could quickly find strong Canadian dividend growth stocks with dependable dividend income.

I had questions like …

I couldn’t find what I was looking for, so I created my own resource instead. And just like that, the Canadian Dividend All-Star List was born.

That was back in 2013, and since then I’ve been sharing the Canadian Dividend All-Star List monthly with my email subscribers.

You see, as a Canadian DIY investor that is looking to rely on dividend income in retirement, I want to make sure I’m investing in high-quality dividend growth stocks that can pay me a reliable and growing stream of dividends for many years to come.

The Canadian Dividend All-Star List helps me find these stocks quickly.

If you would like a copy of the most recent version of the Canadian Dividend All-Star List, sign up below…

I know how overwhelming investing in the stock market can feel. I know how hard it can be to find high-quality stocks that can weather recessions and continue to pay dividends you can rely on in retirement.

The fact is, this will always be a bit of a struggle.

After all, no one can guarantee a dividend won’t be cut, but there are things you can do to stack the odds in your favor.

It is my hope that the Canadian Dividend All-Star List can help you with these challenges.