Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

For those new to the blog, I like to keep my readers up to date on portfolio changes. One of the reasons I started this blog was to educate others, but also improve my own investing. By keeping an open book of my portfolio and changes to it, I hope to generate discussion so that others can see how I put my investing philosophy into practice. My main goal is financial freedom. I plan to achieve this goal by investing in dividend growth stocks and using the dividend payments to cover my expenses. I’m a long way off from retirement, but hopefully this blog and my portfolio updates will keep me on track.

After I completed my dividend stock analysis of CH Robinson Worldwide, I decided I wanted to invest in the company, so I continued my research of the company. After completing this additional research I am revising my estimated future annual dividend growth down. When I completed the dividend stock analysis my estimate for annual dividend growth was 9.2% to 14.8%, likely at the lower end around 10%. I was confused by the most recent low dividend increase of 6.1% as my estimates were quite a bit higher than 6.1%.

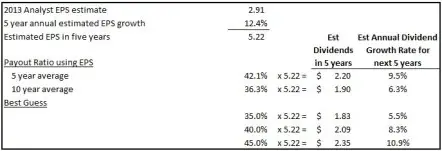

My original estimate used the EPS from the 2012 fiscal end of $3.67, but analysts are estimating EPS of $2.91 for 2013. This caused a mistake in my dividend growth estimate. Using my original payout ratio guess of around 40%, the revised EPS and the estimated 5 year growth EPS growth rate of 12.38% results in annual dividend growth ranging from 5.5% to 10.9%.

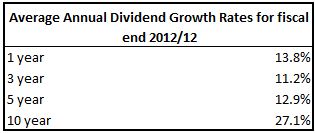

5.5% to 10.9% is quite a bit lower than my original estimate, but with my revised dividend growth estimates the latest 6.1% increase makes more sense. When I look at the past annual average dividend growth rates they are all very good.

I’ve said before that past dividend growth can be used to predict future dividend growth so I think dividend growth will be at the higher end of the 5.5% to 10.9% range, likely around 8% going forward. The company also has high earnings growth targets which are another reason why I think dividend growth will be at the higher end of this range. I grabbed the following from CH Robinson Worldwide’s website.

“our long-term compounded annual growth target has been 15 percent for net revenues, income from operations, and earnings per share. Because our industry is so dynamic and volatile, we don’t predict or make forecasts about short-term expectations.”

I have updated the CH Robinson Worldwide dividend stock analysis with this new information. While I don’t think annual dividend growth will be as high now that my original 10% estimate has dropped to around 8% I am still interested in buying shares. The company has a strong competitive advantage, impressive dividend fundamentals and is below my target price of $56. This is why I bought shares today at $54.25 in my TFSA. With the current quarterly dividend of $0.35 this would result in a yield of 2.58%. Because the shares are US shares and are in my TFSA they are subject to a 15% withholding tax, so my actual yield will be 2.19%.

I’ve updated my portfolio with my latest purchase. You can see my other holdings here.

Photo credit: Historias Visuales / Money Photos / CC BY-NC-SA

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

Thanks for the update and CHRW stock analysis. Why not hold the CHRW stock in your RRSP account to avoid the 15% withholding tax?

With my retirement plan it’s better to contribute to my TFSA right now.