Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

As a way of tracking my progress towards financial freedom I total up the dividends I received each month. The end goal is to have my dividends cover my expenses. This is a long term goal, so I have a lot of years to go, but I find it encouraging to see my dividend income steadily rise over time. This reminds me that I’m on the right track and to stick with it. Here are the results for the month.

My dividend income for February 2014:

Canadian Dividend Income

- Altagas [ALA Trend Analysis] – $33.41

- Potash Corporation of Saskatchewan [POT Trend Analysis] – $53.54

- Royal Bank [RY Trend Analysis] – $16.08

Total February Canadian Dividend Income – $103.03

US Dividend Income

- AT&T [T Trend Analysis] – $17.02

- Proctor & Gamble [PG Trend Analysis] – $9.52

Total February US Dividend Income – $26.59

February pays out the least in the quarter for me, but I was encouraged by some dividend increase announcements from some of holdings. Suncor [SU Trend Analysis] and Pepsi [PEP Trend Analysis] both announced 15% dividend increases. Some of the big banks announced dividend increases. I own Royal Bank of Canada and Bank of Nova Scotia [BNS Trend Analysis], so I was happy to hear about RBC’s 6.0% increase and Bank of Nova Scotia’s 3.2% increase. Both of these banks have been raising their dividend twice a year recently, so while they may seem low, the annual rate is better. That said, I was hoping for a better bump from Bank of Nova Scotia.

AT&T paid me a bit more this month as they paid out one more cent per share than last quarter. With AT&T you get a high dividend yield, but I don’t expect much dividend growth. They have increased their dividend for 30 years in a row which is impressive, but since 2008 they have only increased the quarterly dividend one cent per year. This works out to a dividend growth rate of around 2.0% to 2.5% which is not all that impressive.

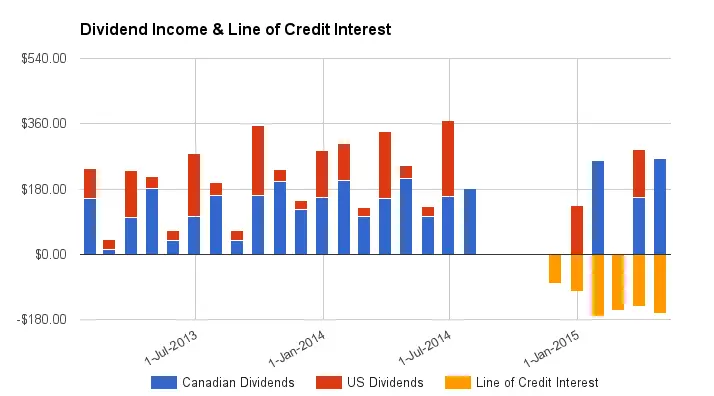

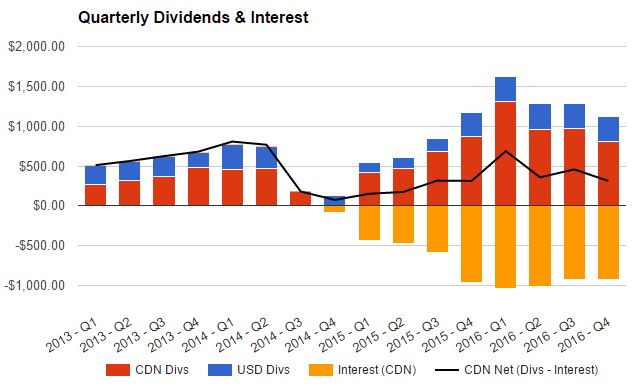

The dividend income chart has been updated on the dividend income page, check it out here: Dividend Income Page. To see a list of the companies currently in my portfolio check out my portfolio page.

Photo credit: bgilliard / Foter / CC BY-SA

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

Looks like you are on the right track because your dividend serves you well. I am now into future planning and that includes putting my money on the right places. Thanks for sharing this post. Will look forward to your future posts.