Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

“Dividends have been a key and underrated part of North American markets’ total returns over the decades. As the British used to say: ‘Milk from the cows, eggs from the hens. A stock, by God, for its dividends.’ ”

David Chilton, The Wealthy Barber Returns

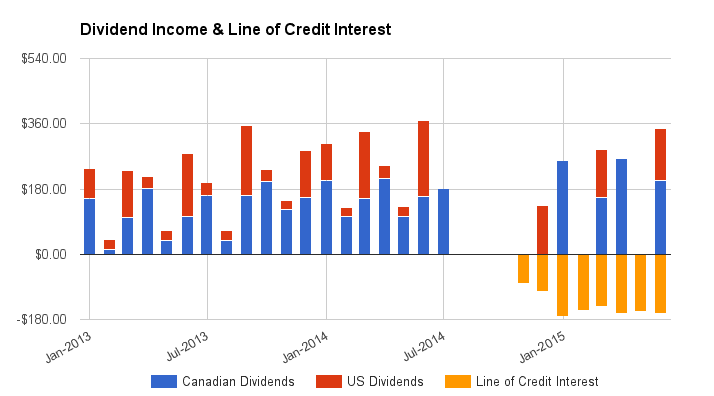

My retirement plan involves collecting an increasing stream of dividend income to help pay for retirement expenses and inflation. While I am a ways off from reaching my long term financial goals, I find it encouraging to track and witness my monthly dividends grow over time. From the quote above it sounds like the British are fans of this too.

May 2015 dividend income

No dividends received in the month.

Line of Credit Interest – $159.05

June 2015 dividend income

June Canadian Dividend Income

- Suncor Energy [TSE:SU Trend Analysis] – $84.00

- Canadian Western Bank [TSE:CWB Trend Analysis] – $118.80

Total June Canadian Dividend Income – $202.80

June US Dividend Income

- IBM [IBM Trend Analysis] – $55.25

- McDonald’s [MCD Trend Analysis] – $87.55

Total June US Dividend Income – $142.80

Line of Credit Interest – $164.34

I’m in the process of building up my portfolio and currently I don’t have any companies that pay dividends in February, May, August, and November. Because of this I didn’t have any dividends paid out in May. I recently purchased Home Capital Group Inc. [TSE:HCG Trend] and Exxon Mobil [XOM Trend], but that will add more dividend income to March, June, September and December. My first dividend payment from these companies will come in September as I purchased them too late for the payment in June. As the portfolio grows and I add new positions I expect the dividend income to smooth out from month to month. In the meantime I’m not too worried about it as I’m not currently living off the dividend income, but instead reinvesting the dividends in new or existing positions.

Related articles: Bird Poop & Portfolio Update: Home Capital Group Inc. Purchased & Portfolio Update: Exxon Mobil Corp. Purchased

Since my last dividend income update IBM increased their dividend 18% and Canadian Western Bank increased their dividend 5% for the second time in the past year. I saw an increased payment from both these companies in June. Always nice to see that the plan is moving along as expected.

For the most up to date chart check the dividend income page. To see a list of the companies currently in my portfolio check out my portfolio page.

What do you think of my progress so far?

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

You seem to be on track. I have a few questions, though.

1) When do you decide that a stock is not pulling its weight and sell it? For example, if a stock that had been increasing dividends at a 10% rate for years and years suddenly maintained but did not increase its dividend in the year you bought the stock, do you decide it is weakening and sell, or do you wait and see?

2) Do you plan to live in Canada during retirement? If so, why not give greater preference to Canadian dividend growth stocks, with their lower tax rate? I see you buying as many US stocks adds Canadian.

(My own answer to the above question is that the USA universe is so much larger for quality Dividend stocks that the fishing is easier, and the research data so much more plentiful. Still, I’d like to hear your answer.)

Hi Len,

1) I’ll usually wait and see if the dividend is held steady. If they cut a dividend I try and sell immediately. If the dividend is held steady I’ll usually wait for a year or two to see if the dividend starts to grow again, if not then I might consider selling. Most of the time in investing its is better to do nothing, so I lean towards the wait and see approach, but it depends on the stock, so ultimately its a case by case decision. I don’t have hard and firm rules for a stock if the dividend is not increased.

2) I plan to be in Canada for retirement so it would be nice to have a higher weighting of Canadian stocks, but to properly diversify I have to go out of the country. Trying to find a dividend growth stock with a wide moat in the Healthcare sector in Canada for instance is really hard, so I don’t limit myself to Canadian stocks only. Like you said, there is a larger universe of great dividend growth companies in the US so if I see one of these companies at a reasonably cheap price I’ll consider buying it.