Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

In an effort to be transparent I like to keep my readers up to date on my portfolio changes. By keeping an open book of my portfolio and changes to it, I hope to generate discussion so others can see how I put my investing philosophy into practice. An added bonus is that it makes me a better investor as I have to rationalize my investing decisions in a blog post. This helps take some of the emotion out of my investing. For the most up to date portfolio changes follow my twitter account as I will usually tweet the day I buy or sell stocks and then follow-up with a blog post sometime later.

Searching for Healthcare Dividend Growth Stocks

I recently re-discovered Novo Nordisk [NVO Trend] while trying to come up with a shortlist of dividend growth stocks I’d be willing to invest in by sector. As a Canadian dividend growth investor it is difficult to invest in the healthcare sector as there aren’t good candidates in Canada. Naturally, I started looking outside Canada to fill in the gaps to my portfolio. This led to my standard starting screen for international dividend growth stocks:

- A wide moat rating from Morningstar.

- 10 or more years of consecutive dividend increases

- A reasonable payout ratio (usually 60% or less)

- A strong financial strength (BBB+ or higher from S&P, or ValueLine Financial Strength rating of B++ or higher).

- A history of moderate to high dividend growth which I expect to continue.

The list of available options using this screen in the healthcare sector gets small in a hurry, but I’m OK with that as I’m only interested in strong dividend growth candidates. Based on the above screening method I identified 6 healthcare dividend growth stocks that I’d be willing to invest in subject to a reasonably cheap valuation. There were 3 more that I’d consider if their payout ratio dropped in the future. Please keep in mind that I’m probably missing a few more companies, but I stopped looking as I felt I had a good list of candidates at this point.

- AmerisourceBergen Corp. [ABC Trend]

- Cardinal Health Inc. [CAH Trend]

- Johnson & Johnson [JNJ Trend]

- Novo Nordisk A/S ADR [NVO Trend]

- Roche Holding AG ADR [RHHBY Trend]

- Stryker Corp. [SYK Trend]

3 Additional High Payout Ratio Stocks:

Based on these 9 stocks, 3 were within 20% of my wish-list price with only one cheap enough for me to consider investing right away: Novo Nordisk. (The other two that were within 20% were Roche Holding and Novartis although both have had slowing dividend growth lately.)

Novo Nordisk

Novo Nordisk is a global healthcare company headquartered in Denmark that focuses on their two business segments: diabetes & obesity care and biopharmaceuticals. They are best known as a major producer of insulin and diabetes-care products as their “world market share for insulin is 47%”. [Source: ValueLine].

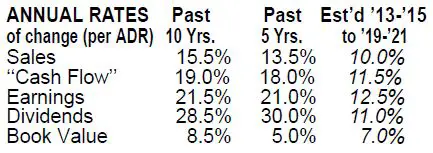

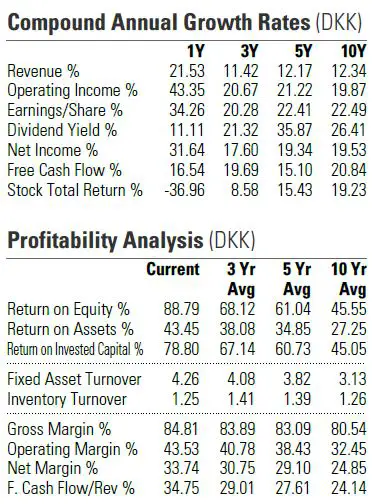

The company is considered a wide moat stock, has an A++ Financial Strength rating from ValueLine and has increased their dividend for 15 consecutive years or more. (After 15 years I stopped looking as this was good enough for me.) The company is based in Denmark so I’m basing the dividend streak on their currency Danish Krone (DKK). Additionally the table below showcases that growth across all levels and profitability over the past 10 years has been fantastic.

Currently they yield about 2.8% based on last year’s 6.4 DKK dividend. The company recently switched from an annual dividend to a semi-annual dividend with the 1st interim dividend in August coming in at 3 DKK. Because of the switch from annual to semi-annual dividend in 2016 some websites are reporting a higher dividend yield by mistake because the 2015 annual payment of 6.4 DKK made in 2016 and 1st interim dividend of 3 DKK were added together. If you look at the analyst’s estimates section of the Novo Nordisk website they are currently estimating a 7.24 DKK total dividend for the fiscal 2016 year, which would be a yield of 3.2%. We don’t know if the total dividend will be 7.24 DKK yet as this is based on analyst estimates, but I think it is reasonable to assume that a yield of 3% or higher based on today’s prices and currency is a fair estimate of the current dividend yield.

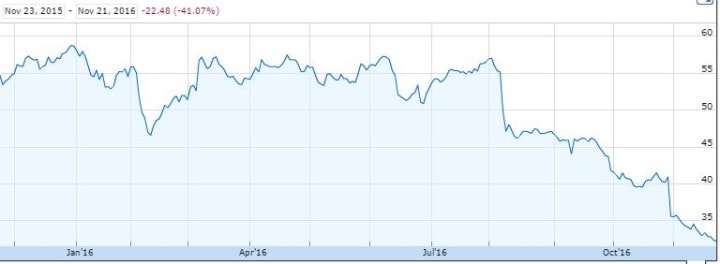

The average dividend yield for Novo Nordisk ADR shares has ranged from 0.7% to 1.9% from 2000 to 2015. [Source: ValueLine]. Based on this, today’s dividend yield of around 3% is very high for the company and suggests a reasonably cheap valuation. This cheap valuation isn’t surprising considering that the company’s stock has dropped 40% in the past year.

So why the big drop in price?

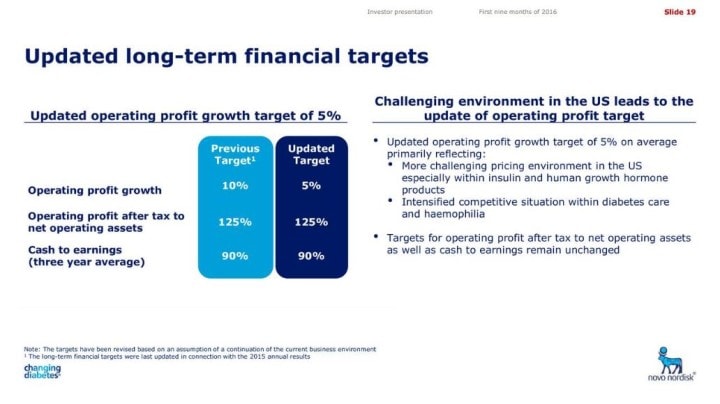

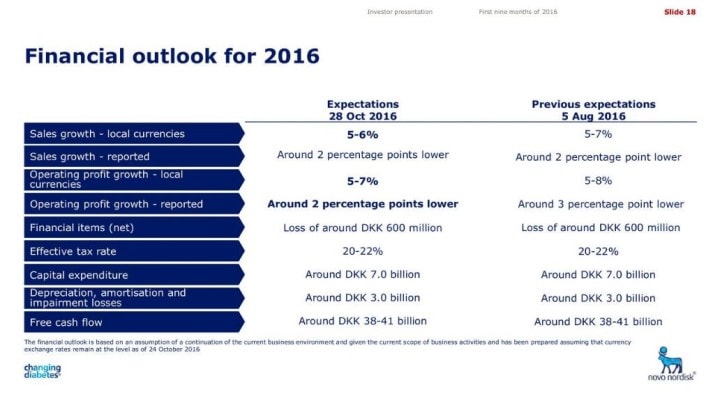

Expectations… This was considered a growth stock, but management has lowered expectations twice this year which had a negative effect on the stock price. Originally they were calling for 15% growth in operating profit, but they lowered that to 10% earlier in the year. Then near the end of October they further reduced this operating profit growth target to 5% from 10%.

Additionally the company also announced that they were not progressing with their development of oral insulin which some were expecting additional future growth from.

Additionally the company also announced that they were not progressing with their development of oral insulin which some were expecting additional future growth from.

What to expect going forward

Management is currently expecting 5-6% sales growth and 5-7% operating profit growth, but please keep in mind this outlook has already been revised down twice this year. Management isn’t looking terribly reliable right now with regard to expectations.

5-7% is certainly not the great 20%+ growth rates that investors had previously come to expect from the company, but still reasonable in my mind. With share buybacks I’d expect EPS to grow in the high single digits and dividends to grow at a similar pace. ValueLine is currently estimating average annual dividend growth of 11% in the next 3-5 years, but they made this estimate before management lowered their expectations a 2nd time in late October so when they come out with revised estimates I’d expect them to be a bit lower from the ones shown below.

Conclusion

At the end of the day when I look at Novo Nordisk, I see a reasonably cheap, financially strong, wide moat healthcare dividend growth stock with a decent starting yield and a good chance of high single digit dividend and earnings growth. In today’s market I’m hard pressed to find a similar candidate of this caliber which is why on November 21, 2016 I purchased shares of Novo Nordisk ADR shares at a price of $32.48 USD + commission under the NYSE:NVO stock ticker. (They also trade on the Copenhagen stock exchange under the stock ticker NOVO-B.)

I’ve been looking for a while to add a healthcare stock to my portfolio and was happy to do so with Novo Nordisk. What do you think of my recent purchase?

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

It looks like you’ve evaluated this stock very carefully. Healthcare seems to be a good target for dividend earnings potential. Update us with your thoughts on the stock’s performance in the future.

I think t you’re wise to not count on 20% dividend growth rates, or even 11%. Assuming 6-7% dividend growth — in line with sales growth — is more reasonable.

But if Canada is subject to the same 30-36% withholding tax on dividends that the USA is, that reduces the appeal of this stock considerably — despite its excellent financial metrics.

And, the stock has declined considerably so far, and is still heading down. I’d hold off to get a better price, to offset some of the considerable withholding tax.

Or is the withholding tax 27%? Can anyone clarify this point?

I found this Ernst and Young web link: http://www.ey.com/gl/en/services/tax/international-tax/alert–danish-government-publishes-report-on-dividend-withholding-tax.

To quote: “The distributing company is required to apply a WHT of 27% regarding nonresident shareholders. If a nonresident shareholder is tax resident in a country which has concluded a tax treaty or another agreement with Denmark that includes an exchange of information clause, the applicable domestic tax rate is 15%.”

Does this mean you would pay the 27% then have to apply to get your 12% back, or is there some kind of tax treaty between Canada and Denmark that would reduce the w/h to 15%? I had a problem a couple of years back when I bought an Irish company then discovered that there was a bunch of paperwork that had to be done to reduce the w/h tax.

I have the same questions. what would be withholding tax impact under 1) RRSP 2) TFSA 3) non-registered account?

Since this is a US stocks, any reasons you skipped over Cardinal Health, Abbot Lab or AbbieVie?

@BeSmartRich

No impact on holding the investment in a RRSP but you do for all the other accounts. Only RRSP is exempt from the US withholding tax. You should always buy your US dividend stocks in a RRSP.

Happy Holidays.

The main reason is valiation. Cardinal Health is on my radar, but I’d be looking for a price of $63 or lower. Abbot Labs and ABBV aren’t really on my radar. I think when they split they lost their wide most rating from Morningstar so I haven’t looked at them in detail for a number of years. Also I think Abbot had a small recent dividend increase so I’m not sure if high dividend growth is expected in the near term for Abbot. What’s your take on these stocks?

So do you have to pay a withholding tax if you hold NVO (ADS) in a RRSP? Or is it better to put it in a cash account and get the 15% tax treaty?

I don’t answer tax questions on the blog, sorry.