Canadian Dividend All-Star List

Join Newsletter & Send Me The Canadian Dividend All-Star List

- Discover every Canadian stock that has increased its dividend for 5+ years in a row.

- Find dividend-paying stocks that have survived recessions without dividend cuts.

- A great starting point to identify and screen Canadian dividend growth stocks.

How To Find High Yield Dividend Growth Stocks With The Canadian Dividend All-Star List

Join Newsletter & Send Me The Canadian Dividend All-Star List

Testimonials

“DGI&R is a one stop site that supplies all the information you would ever need”

The spread sheet is presented in a very professional manner…the best I have ever seen by far. If a similar spreadsheet was available for the US market you would have all you would ever need.

Beyond the spread sheet the articles & the research put into the articles is also the best I have ever seen. Relative & meaningful to a dividend investor. The most important aspect is the honest presentation of the winners & loses experienced by the writer & founder of this great site.

“A fantastic resource for dividend information.”

I like that it is a no nonsense email sent every month like clock work.

This is very useful dividend data for me. I make a lot of decisions based on this spreadsheet.

I am so grateful for all your hard work which you share with everyone for free! This is a very generous gesture on your part.

I am more than happy to donate…

“just plain hard to beat.”

The information, articles and updates that are included with the detailed stock information is just plain hard to beat. Anyone who is interested in Dividend investing should start their journey with DGIR. I can’t say enough about how good the information provided here is.

“A gold mine for analyzing dividend stocks.”

The information provided is a gold mine for analyzing dividend stocks.

Bond yields are often low and with the value of bonds in question, dividend stocks provide a great alternative.

As a retiree and conservative investor, I find the information DGI&R provides invaluable.

I’ve even happily donated to help keep the lists and the website going.

I can’t recommend DGI&R highly enough.

Join Newsletter & Send Me The Canadian Dividend All-Star List

Canadian Dividend All-Star List

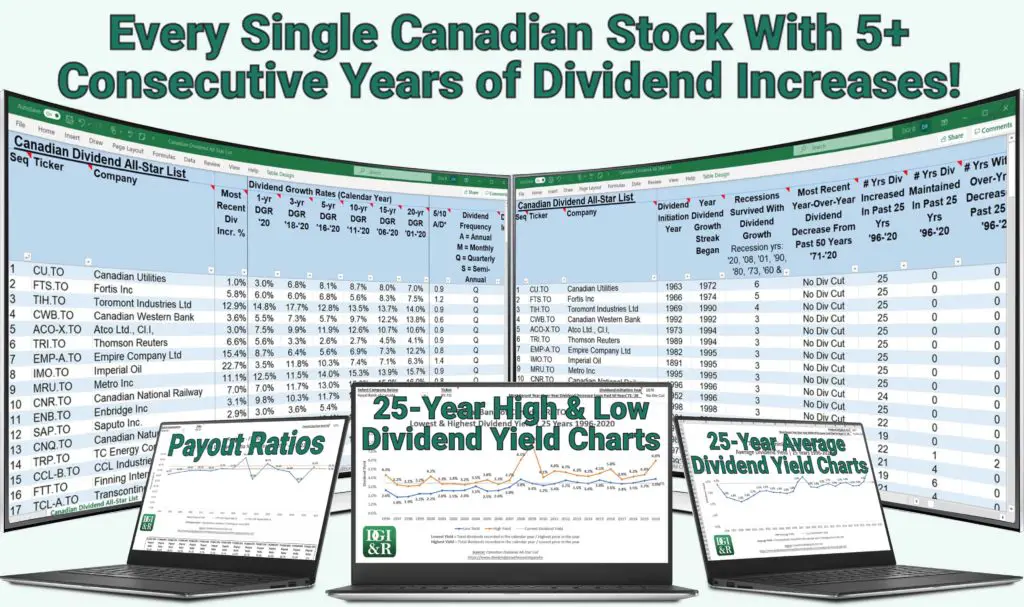

Tons of Dividend Data

Filter through huge amounts of dividend information quickly!

- Dividend Growth Streaks – 1, 3, 5, 10 & 20 Year

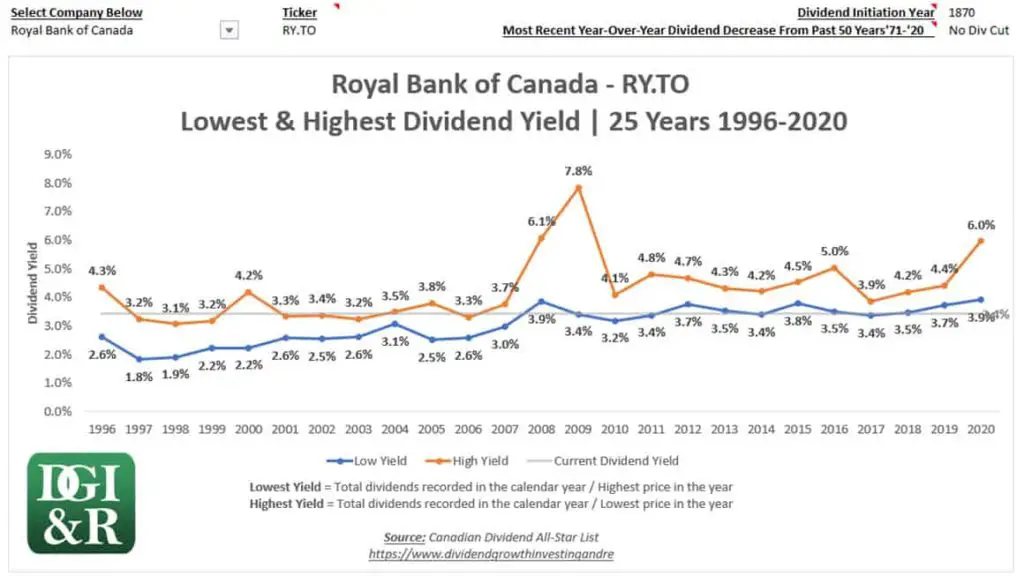

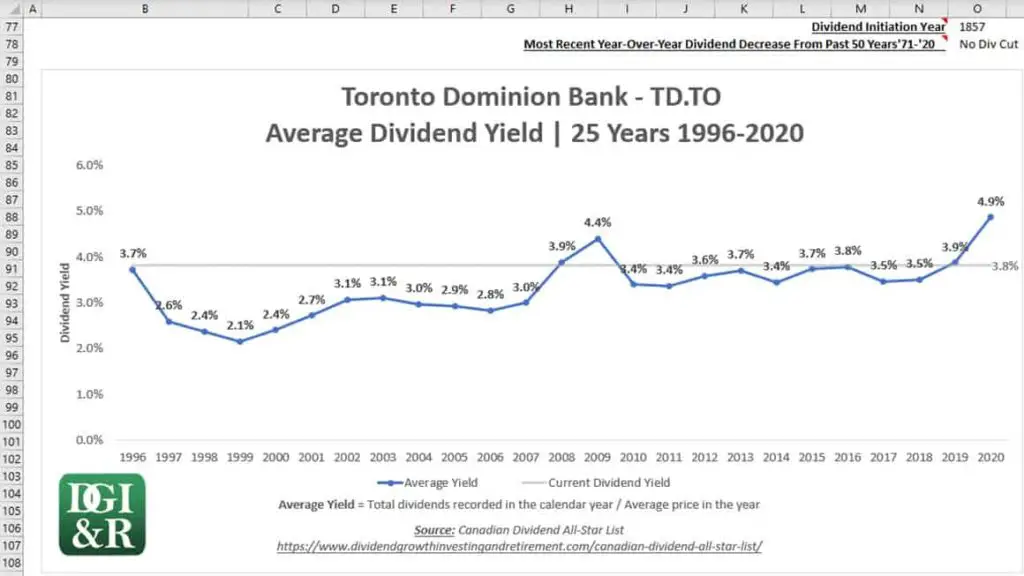

- Dividend Yield % – Current, 3, 5, 10, and 25-Year Low, Average, & High Yields

- Dividend History – Up to 50-Year Dividend Histories, # Recessions Survived with Dividend Growth, Dividend Initiation Year

- Dividend Growth Rates – 1, 3, 5, 10 & 20 Year

- EPS, Sales & Cash Flow Growth Rates – 1, 3, 5 & 10 Year

- Valuation Tools – P/E, P/B, P/Sales, P/Cash Flow, Graham Price, Chowder Rule, Tweed Factor …

- Payout Ratios – EPS, Cash Flow, Free Cash Flow

- Stock Returns % – 1, 3, 5 & 10-Year Price, Dividend & Total Returns

- Dividend Reinvestment Plan (DRIP) Information

- ROE, ROIC, D/E, Current Ratio, Quick Ratio

Join Newsletter & Send Me The Canadian Dividend All-Star List

FAQ

Frequently Asked Questions

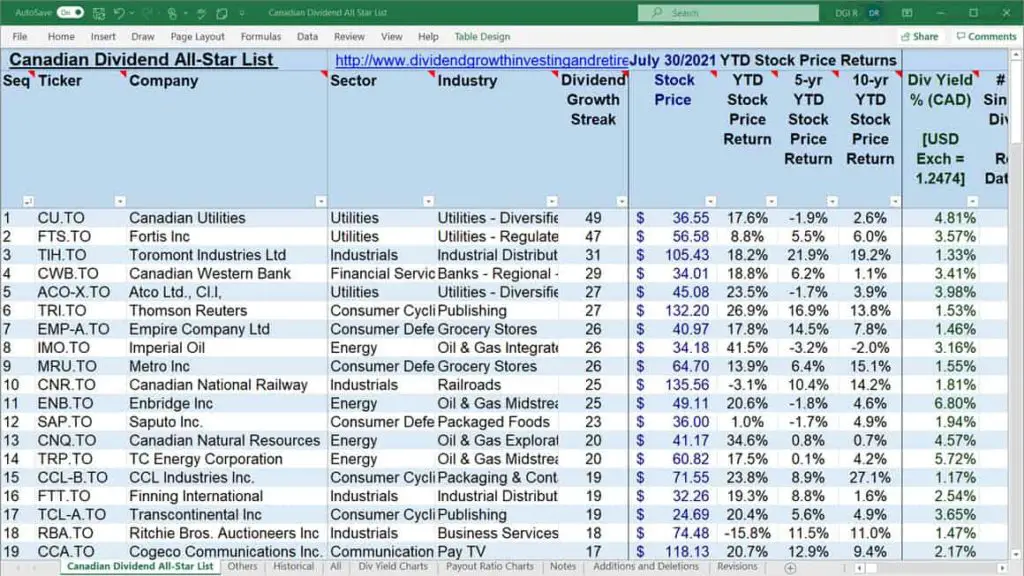

The Canadian Dividend All-Star List is the perfect resource to quickly find strong Canadian dividend growth stocks with dependable dividend income. It’s one of the website’s most popular resources.

It is an excel spreadsheet with a huge amount of stock information on Canadian companies that have increased their dividend for 5 or more calendar years in a row.

This valuable resource is emailed monthly to DGI&R subscribers and is typically used as a starting point to identify and screen Canadian dividend growth stocks.

There is too much information in the Canadian Dividend All-Star List to explain everything here, so instead I’ll share two “How To” videos and then I’ll let you experiment with it more.

Every Canadian listed stock that has increased its dividend for 5 or more years in a row is on the list.

Unlike the S&P/TSX Canadian Dividend Aristocrats Index there aren’t minimum market capitalization or low trading volume limits so when I say every stock I mean it.

You’ll find way more information on these stocks in the Canadian Dividend All-Star List, but for now here is a table of all the stocks in the Canadian Dividend All-Star List and their dividend growth streak.

The table is sorted by dividend growth streak and then alphabetically by company name.

| Stock Ticker | Company Name | Dividend Growth Streak |

|---|---|---|

| TSE:CU | Canadian Utilities | 49 |

| TSE:FTS | Fortis Inc | 47 |

| TSE:TIH | Toromont Industries Ltd | 31 |

| TSE:CWB | Canadian Western Bank | 29 |

| TSE:ACO.X | Atco Ltd. | 27 |

| TSE:TRI | Thomson Reuters | 27 |

| TSE:EMP.A | Empire Company Ltd | 26 |

| TSE:IMO | Imperial Oil | 26 |

| TSE:MRU | Metro Inc | 26 |

| TSE:CNR | Canadian National Railway | 25 |

| TSE:ENB | Enbridge Inc | 25 |

| TSE:SAP | Saputo Inc. | 23 |

| TSE:CNQ | Canadian Natural Resources | 20 |

| TSE:TRP | TC Energy | 20 |

| TSE:CCL.B | CCL Industries Inc | 19 |

| TSE:FTT | Finning International | 19 |

| TSE:TCL.A | Transcontinental Inc | 19 |

| TSE:RBA | Ritchie Bros Auctioneers | 18 |

| TSE:CCA | Cogeco Cable Inc | 17 |

| TSE:T | Telus Corporation | 17 |

| TSE:CGO | Cogeco Inc | 16 |

| TSE:IFC | Intact Financial | 16 |

| TSE:SJ | Stella-Jones Inc. | 16 |

| TSE:ADW.A | Andrew Peller Ltd | 15 |

| TSE:XTC | Exco Technologies Ltd | 15 |

| TSE:BYD | Boyd Group Services Inc. | 14 |

| TSE:EMA | Emera Incorporated | 14 |

| TSE:ENGH | Enghouse Systems Limited | 14 |

| TSE:BIP.UN | Brookfield Infrastructure Partners LP | 13 |

| TSE:FNV | Franco-Nevada Corp | 13 |

| TSE:TCS | Tecsys Inc. | 13 |

| TSE:BCE | BCE Inc | 12 |

| TSE:ATD.B | Alimentation Couche-Tard Inc | 11 |

| TSE:BEP.UN | Brookfield Renewable Energy Partners LP | 11 |

| TSE:LGT.B | Logistec Corporation | 11 |

| TSE:MG | Magna International Inc | 11 |

| TSE:NA | National Bank | 11 |

| TSE:WCN | Waste Connections Inc | 11 |

| TSE:AQN | Algonquin Power & Utilities Corp. | 10 |

| TSE:BNS | Bank of Nova Scotia | 10 |

| TSE:CM | Canadian Imperial Bank of Commerce | 10 |

| TSE:CTC.A | Canadian Tire Corp Ltd | 10 |

| TSE:DOL | Dollarama Inc. | 10 |

| TSE:EQB | Equitable Group Inc | 10 |

| TSE:EIF | Exchange Income Corporation | 10 |

| TSE:GRT.UN | Granite Real Estate Investment Trust | 10 |

| TSE:GCG.A | Guardian Capital Group Ltd. | 10 |

| TSE:HDI | Hardwoods Distribution Inc. | 10 |

| TSE:KEY | Keyera Corp. | 10 |

| TSE:RY | Royal Bank of Canada | 10 |

| TSE:SYZ | Sylogist Ltd. | 10 |

| TSE:TD | Toronto Dominion Bank | 10 |

| TSE:TFII | TFI International Inc. | 10 |

| TSE:AP.UN | Allied Properties Real Estate Investment Trust | 9 |

| TSE:BMO | Bank of Montreal | 9 |

| TSE:BAM.A | Brookfield Asset Management Inc | 9 |

| TSE:CAR.UN | Canadian Apartment Properties Real Estate Investment Trust | 9 |

| CVE:FCD.UN | Firm Capital Property Trust | 9 |

| TSE:FN | First National Financial Corp | 9 |

| TSE:WN | George Weston Ltd | 9 |

| TSE:IIP.UN | InterRent Real Estate Investment Trust | 9 |

| TSE:L | Loblaw Companies Limited | 9 |

| TSE:PPL | Pembina Pipeline | 9 |

| TSE:STN | Stantec Inc | 9 |

| TSE:CGI | Canadian General Investments, Limited | 8 |

| TSE:CRT.UN | CT Real Estate Investment Trust | 8 |

| TSE:MAL | Magellan Aerospace Corporation | 8 |

| TSE:ONEX | Onex Corp | 8 |

| TSE:OTEX | Open Text Corporation | 8 |

| TSE:PKI | Parkland Corporation | 8 |

| TSE:PBH | Premium Brands Holdings Corp | 8 |

| TSE:SIS | Savaria Corporation | 8 |

| TSE:CPX | Capital Power Corporation | 7 |

| TSE:GWR | Global Water Resources Inc. | 7 |

| TSE:IAG | Industrial Alliance | 7 |

| TSE:INE | Innergex Renewable Energy Inc. | 7 |

| TSE:MFC | Manulife Financial Corporation | 7 |

| TSE:SGR.UN | Slate Grocery REIT | 7 |

| TSE:SRU.UN | Smart Real Estate Investment Trust | 7 |

| TSE:CSH.UN | Chartwell Retirement Residences | 6 |

| TSE:FSV | FirstService Corporation | 6 |

| TSE:GSY | goeasy Ltd. | 6 |

| TSE:GWO | Great-West Lifeco Inc. | 6 |

| TSE:MFI | Maple Leaf Foods Inc. | 6 |

| TSE:POW | Power Corporation of Canada | 6 |

| TSE:QBR.B | Quebecor Inc. | 6 |

| TSE:QSR | Restaurant Brands International Inc. | 6 |

| TSE:QSP.UN | Restaurant Brands International Limited Partnership | 6 |

| TSE:RAY.A | Stingray Digital Group Inc. | 6 |

| TSE:SLF | Sunlife | 6 |

| TSE:AEM | Agnico Eagle Mines Limited | 5 |

| TSE:BDGI | Badger Infrastructure Solutions Ltd | 5 |

| TSE:CP | Canadian Pacific Railway Ltd | 5 |

| TSE:H | Hydro One Limited | 5 |

| TSE:MRG.UN | Morguard North American Residential Real Estate Investment Trust | 5 |

| CVE:SVI | StorageVault Canada Inc. | 5 |

| TSE:X | TMX Group Limited | 5 |

| TSE:WBR | Waterloo Brewing Ltd. | 5 |

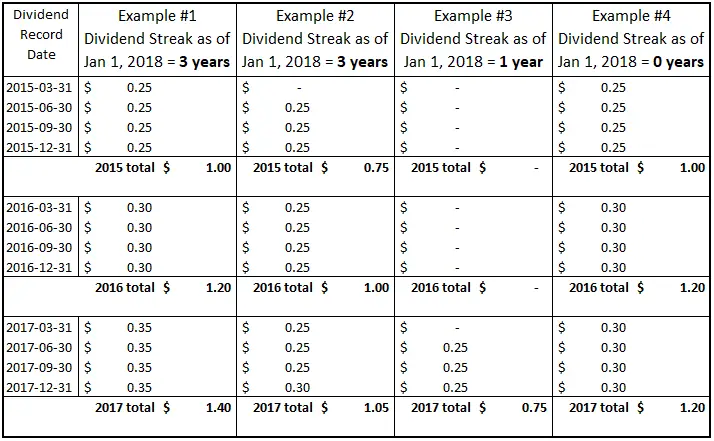

A Dividend Growth Streak is the number of consecutive calendar years the company has increased their regular dividend for.

Special dividends are not considered when determining the streak length. For instance, if a company pays out a one-time special dividend on top of their regular dividends that results in a higher dividend in the previous year they will not be penalized because of this. The dividend growth streak only focusing on the increases of regular dividends.

The dividend record date based on a calendar year (January to December) is used to determine the dividend growth streak length. There are a variety of different key dividend dates that occur like the dividend record date, payable date, ex-date, and declared date. Because of the timing differences between these dates, it is possible for a company to have a longer or shorter dividend streak based on the payable/ex/declared date, but not on the record date, etc. Something to be aware of.

If the company initiated a dividend it is counted as an increase. For instance, if a company was not paying a dividend and then start this year, their streak would be 1 year.

The dividend streaks are updated annually at the end of the calendar year in December.

To understand how the streaks are calculated let’s look at a few examples.

- Example #1: The company increases the dividend each year at the beginning of the year so the dividend streak is 3 years. This is what most people think of when they think of a dividend streak.

- Example #2: The dividend streak is 3 years despite having only one dividend increase after initiating a dividend in the 1st year. If total regular dividends for the year are more than the previous year, the streak continues.

- Example #3: If the company initiates a dividend, I count that as year one in the dividend streak.

- Example #4: The 2017 total dividends of $1.20 are the same as the prior-year so the dividend streak is 0 years.

Monthly.

The Canadian Dividend All-Star List is updated every month using stock information from the last trading day of the month. It is then emailed to Dividend Growth Investing & Retirement (DGI&R) email subscribers at the beginning of every month.

If you are a new email subscriber, you’ll be emailed a copy of the most recent version after signing up.

No, not one that I maintain.

That said, you can find something similar called the US Dividend Champions List on the Dividend Investing Resource Center.

The Dividend Investing Resource Center also has other international dividend lists like the:

- Eurozone Dividend Champions,

- UK Dividend Champions, and

- Global CCC List.

NO!

My website, Dividend Growth Investing & Retirement, and the Canadian Dividend All-Star List do not provide stock recommendations.

I created the Canadian Dividend All-Star List as an information source for dividend investors. The criteria to be on the list is based on the number of years the dividend has increased, it is not based on whether I think the stock is a good investment. Think of this list as a good starting point if you are looking for potential Canadian dividend growth candidates, not stock recommendations.

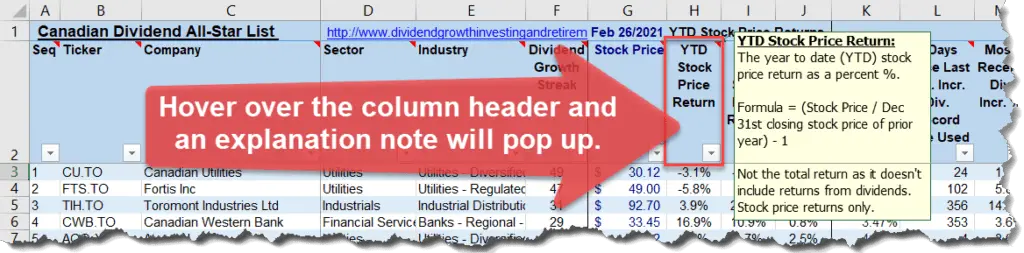

Can’t understand a column header in the Canadian Dividend All-Star List spreadsheet?

Hover over the header column and read the note that pops up to get a brief explanation.

The difference between the two tabs in the excel file are …

“Canadian Dividend All-Star List” Tab

The stocks in the “Canadian Dividend All-Star List” tab need to have a dividend streak of 5 years or more. i.e. 5 or more years of consecutive annual dividend increases.

“Others” tab

The stocks in the “Others” tab pay a dividend and are generally thought to be dividend growth stocks, but there are no specific criteria to be included in the “Others” tab.

Pay particular attention to the number of days since the last recorded dividend increase (column L) as some of these stocks have not increased their dividend for a number of years.

The Canadian Dividend All-Star List was created because I was frustrated with the lack of coverage and data on Canadian dividend growth stocks.

My retirement plan relies on dividend income, so I wanted a resource where I could quickly find strong Canadian dividend growth stocks with dependable dividend income.

I had questions like …

- Which Canadian stocks have increased their dividend for 5, 10, or 25 years in a row?

- Which dividend stocks have high dividend yields, and strong 1, 3, 5, 10, 15, and 20-year dividend growth rates?

- How many recessions has the company been able to increase their dividend through?

- Which Canadian dividend growth stocks look cheap?

- The list goes on …

I couldn’t find what I was looking for, so I created the Canadian Dividend All-Star List (CDASL) and I’ve been sharing it monthly with my readers since 2013.

Use the Donate page here to make a donation.

To create and update the Canadian Dividend All-Star List takes a lot of time and effort, so donations are very much appreciated and always welcome.

Thanks in advance!

While I have tried my best to provide accurate information, I am subject to human error.

Finding the dividend history to four decimal places can be difficult when looking at older payments and considering splits and rounding.

The file contains a mix of information pulled from various sources and data I entered manually. Data entered by myself has come primarily from the company’s investor relations website or their annual reports. The annual reports were taken from the company website or www.sedar.com. In the few instances where I was unable to find the dividend history from the company website or the annual report, I used TMX, Yahoo! Finance, Morningstar, Google Finance, etc. and compared the information. Some of the stock information that is pulled directly from various sources is assumed to be correct, but I have not confirmed this.

I have tried to provide accurate information, but I cannot guarantee the accuracy of the information. You have been warned.

I am happy to share this information with as many individual investors as possible, but this list is not intended to be used for commercial use unless you have received written permission from me.