Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

Each month I update readers of all the dividend increases in the Canadian Dividend All-Star List (Canadian companies that have increased their dividend for 5 or more years in a row.) along with a summary of these companies.

Tracking recent dividend increases can be a good way to generate new dividend growth stock ideas as dividend increases can be a sign from management that they feel good about the future.

“a 2004 paper by A. Koch and A. Sun of Carnegie Mellon University suggested, with a batch of interesting statistics, that investors bought dividend growth stocks not for the signal that management was providing about the future, but because the dividend growth confirmed what management had already reported about the past. In these days of aggressive CEOs and accounting at many firms, consideration of dividend growth as a kind of litmus test of previously reported earnings is not a trivial feature. Take your pick: a signal about future prospects or a verification of past reports—in either case itʼs bottom-line valuable information available nowhere else about your investment.”

Source: The Single Best Investment: Creating Wealth with Dividend Growth by Lowell Miller (AL. I own and highly recommend this book.)

This month there were 2 dividend increases; a 9.1% increase from Empire Company Ltd. (TSE:EMP.A), and a 4.9% increase from Andrew Peller Ltd. (TSE:ADW.A).

June 2019 Dividend Increases in the Canadian Dividend All-Star List

Table of Contents – You can use the links below to jump ahead to the company you are interested in.

- Empire Company Ltd (TSE:EMP.A) – 9.1% Dividend Increase

- Andrew Peller Ltd. (TSE:ADW.A) – 4.9% Dividend Increase

What is the Canadian Dividend All-Star List (CDASL)?

The CDASL is an excel spreadsheet with a lot of stock information that is typically used as a starting point to identify and screen Canadian dividend growth stocks. The list has been updated monthly since early 2013 and it is the most popular resource of my website.

Download CDASL

Subscribe to the Dividend Growth Investing & Retirement newsletter and you'll be emailed the download link for the most recent version of the Canadian Dividend All-Star List (CDASL).

OK, now on to the dividend increases…

1. Empire Company Ltd (TSE:EMP.A) – 9.1% Dividend Increase

Empire Company operates a Canadian chain of grocery stores through wholly-owned subsidiary Sobeys Inc. They have more than 1,500 retail stores (corporate, franchise, affiliate) as well as over 350 retail fuel locations, operating in every province and in more than 900 communities across Canada. They also have a 41.5% equity accounted interest in Crombie REIT.

Sobeys is one of only two national grocery retailers in Canada, serving the food shopping needs of Canadians under retail banners that include Sobeys, Safeway, IGA, Foodland, FreshCo, Price Chopper, Thrifty Foods and Lawtons Drugs.

Empire Company Dividends

Empire Company Ltd which has a dividend streak of 24 years recently increased their quarterly dividend 9.1% from $0.1100 CAD to $0.1200 CAD. This dividend increase comes into effect with the dividend recorded on Jul 15, 2019.

The dividend yield as of July 15, 2019, was 1.4%, and they have 5 and 10-year average annual dividend growth rates of 5.2% and 6.6% respectively.

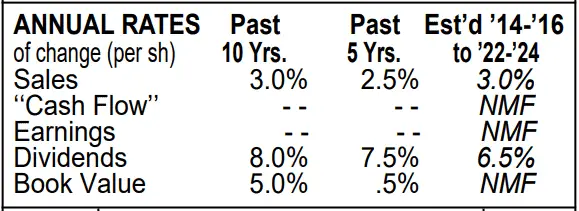

Value Line is estimating future dividend growth of 6.5% over the next 3-5 years.

Source: April 19, 2019, Value Line Report

Related articles: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks & How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]

Empire Company Financial Strength

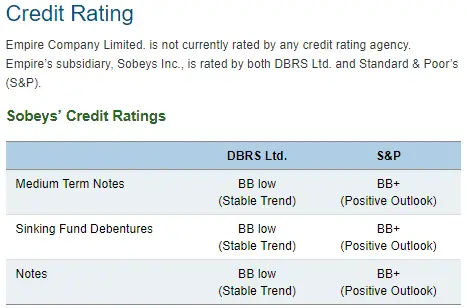

At 24 years, its dividend streak is impressive as this is the seventh-longest dividend streak among Canadian companies, but its credit ratings are too low for me to consider it at this time. I generally want to see a credit rating of BBB+ before I invest.

The company or I should say its main subsidiary Sobey’s has BB low and BB+ ratings right now. Empire Company Ltd is not currently rated by any agencies.

Source: Empire Company Limited Investor Centre website

The poor financial strength of this company and the low dividend yield make it a pass for me. Value Line gives a financial strength rating of B++ for Empire.

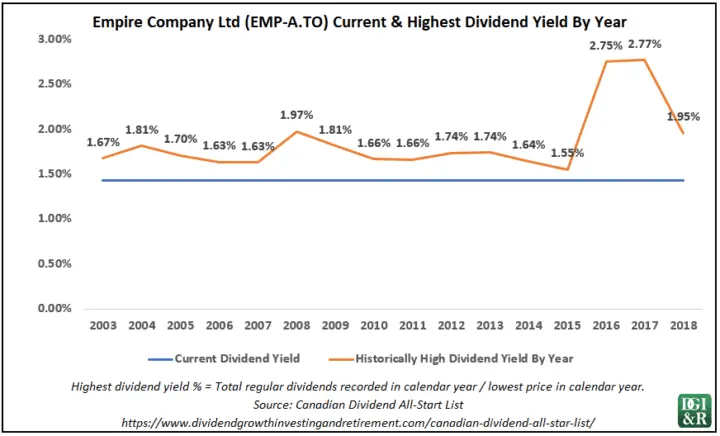

Empire Company Historically High Dividend Yields

The current dividend yield of 1.4% is historically low for the company.

A historically low dividend yield suggests that the stock is currently expensive. A better entry would be around 2.5% or more, but even that is low.

Please keep in mind that using dividend yield as a valuation tool is usually less reliable for lower-yielding companies, which I why it’s good practice to look at a variety of different valuation metrics.

Empire Company Final Thoughts

Sure, everyone needs groceries, but as an investment, this is not a company I’m interested in. The dividend yield is too low, and the financial strength and credit ratings are too low.

[Back to Table of Contents] [Jump to Summary]

2. Andrew Peller Ltd. (TSE:ADW.A) – 4.9% Dividend Increase

Andrew Peller Limited is one of Canada’s leading producers and marketers of quality wines and craft spirits. The company was founded in 1961 and has been paying dividends every year since 1979. With wineries in British Columbia, Ontario, and Nova Scotia, the Company markets wines produced from grapes grown in Ontario’s Niagara Peninsula, British Columbia’s Okanagan and Similkameen Valleys, and from vineyards around the world. Currently, the Company has an estimated 10.2% share in the English Canada wine market, with the Company’s Peller Estates brand the top‐selling wine in this market.

Source: Q4 FY19 Fact Sheet

“The Company is the second largest winery in Canada with 5.9% share of the wine market in total Canada for the 12-month rolling period ended March 2019 … The largest wine company in Canada is Arterra Wines with a 12.0% share of the market.”

Source: June 12, 2019, Annual Information Form

Andrew Peller Dividends

Andrew Peller Ltd. which has a dividend streak of 13 years recently increased their quarterly dividend 4.9% from $0.0513 CAD to $0.0538 CAD. This dividend increase comes into effect with the dividend recorded on Jun 28, 2019.

The dividend yield as of July 15, 2019, was 1.5%, and they have 5 and 10-year average annual dividend growth rates of 8.9% and 7.1% respectively.

Andrew Peller Financial Strength

Normally I like to see a BBB+ or equivalent credit rating before I’ll consider investing, but Andrew Peller is a small company with a market cap of a little over $600 million and the rating agencies don’t cover the company.

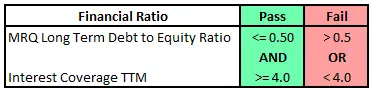

A lot of smaller companies aren’t rated by any of the credit rating agencies so I do my own very crude test before digging into their financials more.

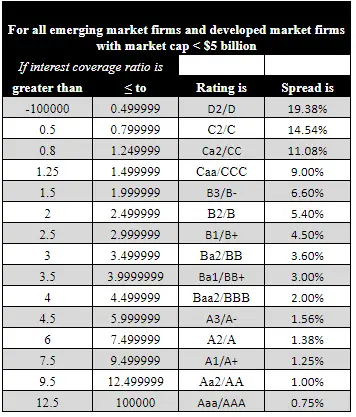

To pass my financial strength test I require an interest coverage ratio of 4:1 or higher and a long-term debt/equity ratio of 50% or less. This is for non-financial service companies only.

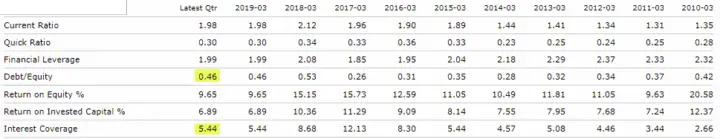

Andrew Peller passes my very crude financial strength test as it has a debt to equity ratio of 0.46 which is less than 0.5, and its interest coverage ratio of 5.44 is above 4.

Source: Morningstar

A bit more information on my financial strength test

The 50% debt/equity ratio requirement comes from one of Lowell Miller’s financial strength requirements in his book The Single Best Investment: Creating Wealth with Dividend Growth (AL).

For small non-financial companies an interest coverage ratio of 4:1 is generally thought to be about equivalent to a BBB rating. In January 2019, Aswath Damodaran ran the data on the link between interest coverage ratios and credit ratings by looking at all rated companies in the United States. The results for non-financial service companies with a market cap of less than $5 billion are shown below:

Source: http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/ratings.htm

The table above doesn’t specify an equivalent interest coverage ratio to a BBB+ rating, but BBB is pretty close. Between the debt/equity and interest coverage ratios, it should be around a similar pass level to the BBB+ credit rating, albeit it is a much cruder method than the rating agencies use.

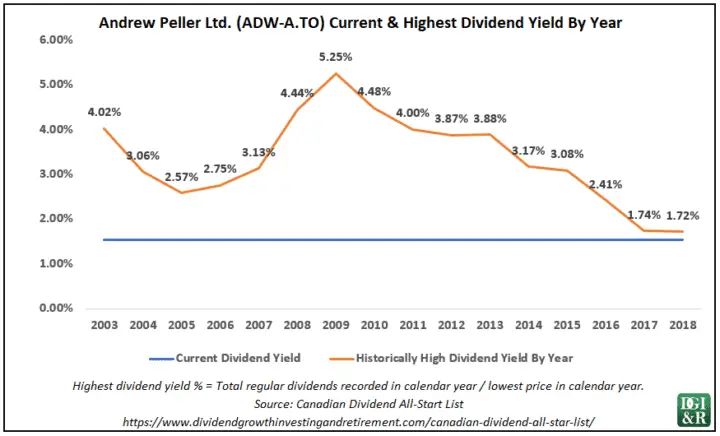

Andrew Peller Historically High Dividend Yields

The current yield of 1.5% is historically quite low for the company.

I’m trying to invest in companies that have a starting yield of 4% or more, so Andrew Peller isn’t really on my radar right now.

Andrew Peller Final Thoughts

I’d like to own a high-quality company in an alcohol-selling industry, but Andrew Peller’s yield is just too low for me to get excited. That and it’s a pretty small company. Should the yield increase substantially I’ll start looking into them more at that time.

Summary

Monitoring dividend increases is a good idea because it can be a sign from management that they feel good about the prospects of the company.

In June 2019 there were 2 dividend increases in the Canadian Dividend All-Star List (An excel spreadsheet with a lot of stock information on all Canadian companies that have increased their dividend for 5 or more calendar years in a row.):

- Empire Company Ltd (TSE:EMP.A) – 9.1% Dividend Increase

- Andrew Peller Ltd. (TSE:ADW.A) – 4.9% Dividend Increase

Of these 2 companies, I prefer Andrew Peller because of the better financial position, but both have too low of a dividend yield for me to be seriously interested.

I’d like to own a company in the alcohol selling business, but the options in Canada are limited and restricted to quite small companies.

In researching Andrew Peller I ended up going down a bit of a rabbit hole and started looking into Corby Spirits and Wine Ltd. (TSE:CSW.A). Corby is a small Canadian company in a similar industry, but its focus is more on spirits than wine. They are controlled by Pernod Ricard which is a French company and the world’s second-largest wine and spirits seller.

What intrigues me about Corby, is that they have no debt. No debt is a good thing, but their payout ratio is high so it’s not clear if they’ll continue to increase the dividend in the near term.

Do you have any suggestions for dividend growth companies that sell alcohol?

Disclosure: I do not own shares of any of the above-mentioned stocks. You can see my portfolio here.

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

Thanks for the post. Always enjoy reading them. I found the analysis on Andrew Peller of particular interest (i.e. evaluating a smaller company).

Hi,

I fully agree that the yield is too low on Peller for me to consider as well. One thing I’d like your opinion on is the low “quick ratio” of .30. I’ve read elsewhere that a quick ratio of <1.0 is a danger signal that indicates that current liabilities exceed current assets. Do you use the quick ratio in your financial strength analysis? Thanks again for another great article.

I think you might be confusing the current and quick ratios, but yes, in general, a quick ratio of less than 1.0 can be a warning sign. In Andrew Peller’s case, their quick ratio has ranged from 0.23 to 0.36 over the past decade per Morningstar, so the current 0.3 seems in-line with past ratios. The current ratio is 1.98 for them right now per morningstar.

The current ratio is all the current assets divided by the current liabilities, so in Andrew Peller’s case, current assets exceed current liabilities.

The quick ratio is more conservative than the current ratio because it doesn’t include inventory and other current assets that are more difficult to liquidate (i.e., turn into cash). By excluding inventory, and other less liquid assets, the quick ratio focuses on the company’s more liquid assets.