Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

They say the hardest lessons in life are learned through experience. Well let’s just say a 38.6% loss in about a month is a lot of “experience”.

On November 6, 2015, and December 1, 2015, I purchased shares of a stock that was yielding 8-9% and was guiding annual dividend growth of 6-10% for the next few years. The company had a wide moat and a long dividend streak.

Unlike other companies that typically increase their dividend once a year, they’d started increasing dividends every quarter. I got in after the 7th consecutive quarterly dividend increase.

Sounds like every dividend growth investor’s dream, right?

Not so fast …

A week after my 2nd purchase they cut the dividend 75% and I sold the stock; Kinder Morgan Inc. (NYSE:KMI), for a 38.6% loss.

Source: https://ir.kindermorgan.com/dividend-history

Here is the 8th lesson I learned in the last part of this 5-part series covering the “8 Lessons I Learned from One of My Worst Dividend Growth Investments” …

You can check out the other lessons here:

- Lesson 1 & 2: Maintaining an “Investment Grade” Credit Rating Matters & Financial Strength Should Never Be Overlooked

- Lesson 3 & 4: Don’t Trust Management If the Numbers Don’t Make Sense & Never Ignore the Payout Ratio

- Lesson 5: When the Dividend Yield Gets Really High, It’s A Warning Sign That A Dividend Cut May Be Coming.

- Lesson 6 & 7: Diversification & Asset Allocation Matter & Don’t Forget Income Allocation Too!

Lesson 8: Know Yourself, Make A Plan and Be Patient

My investing strategy involves buying high-quality and high-yield dividend growth stocks at reasonably cheap valuations. This strategy involves a lot of waiting around for stocks to meet my investment criteria.

“The trick in investing is just to sit there and watch pitch after pitch go by and wait for the one right in your sweet spot. If people are yelling, ‘Swing, you bum,’ ignore them.”

Source: Warren Buffett, billionaire and one of the most successful investors of all time.

Turns out, I’m not great at waiting …

You see, I like investing, so waiting a long time for the right price to buy at, is a hard strategy to follow.

Being patient when investing is hard for a lot of us because investing offers a chance to “win big”, is exciting, and you get an adrenaline rush, similar to that of a gambler.

Investing is risky, and where there is risk, there will be a rush from seeking excitement, relief from boredom, and sometimes feelings of accomplishment.

Yes, the level of risk will vary depending on your strategy, but investing will always have some element of risk to it. Therefore …

Investors will always have an inner-conflict between their emotional responses to risk-taking and sticking to a rational investment strategy.

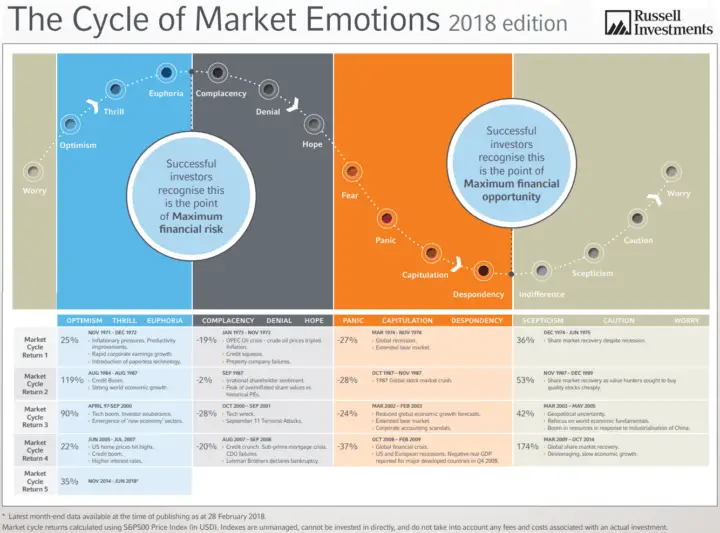

A good example of this is the cycle of market emotions

Source: The Cycle of Market Emotions 2018 – Russell Investments

How I Feel When Investing

I get nervous and excited as I wait in anticipation as a stock price gets closer to the price I want to buy it at.

I get anxious as a stock price gets closer to my target buy price, and I experience a fear of missing out (FOMO).

Thoughts like these will start to cross my mind:

What if the stock doesn’t drop another 3% and I miss my opportunity to buy this great dividend growth stock?

I have cash to invest, and time in the market is better than timing the market, so I might as well buy stocks now … right?

The more time that passes without investment activity, the more likely my emotions will start to creep in, and I’m liable to do something stupid instead of rational.

My Embarrassing and Stupid Kinder Morgan Purchase

When I first looked at Kinder Morgan back in 2015, I was very excited to find a wide-moat dividend growth stock that was yielding 8-9% and was guiding annual dividend growth of 6-10% for the next few years.

The company had a long dividend streak and had recently been increasing dividends every quarter instead of every year. I bought after the 7th consecutive quarterly dividend increase.

Kinder Morgan was a high-yield dividend growth stock trading at a reasonably cheap valuation, but it was missing elements of a high-quality stock. Namely, a sustainable dividend and strong financial strength.

In my excitement to buy this stock, I ignored obvious red flags like:

- A very high dividend yield,

- Earnings and cash flow payout ratios which were close to or above 100%,

- High debt levels, and

- A BBB- credit rating (the lowest of the investment-grade ratings).

I justified my decision at the time with thoughts like:

If dividends send signals, surely 7 quarterly dividend increases in a row must be a good sign?

Sure, the payout ratios are high, but management has said they are planning to grow the dividend 6-10%/year over the next few years.

Even if they don’t increase the dividend 6-10%, I’m still getting paid 8-9% in dividends now.

Well, flash forward about a month, and Kinder Morgan cut the dividend 75%, and I sold my shares for a 38.6% loss.

After I sold my shares, I felt embarrassed, disappointed, ashamed and stupid.

What really made me feel bad though, was explaining this to my partner as we have combined finances. Making such a stupid decision with not just mine, but my partner’s money too, made me feel awful.

I felt guilty even though my partner took the news really well. My partner pointed out that yes, we lost some money, but it wasn’t a catastrophic amount. We both understood that we’d suffer some losses when investing as everyone does at some point or another. This was one of those times.

I can only imagine how awful I’d have felt if my partner didn’t take it so well.

Or what about if we’d been in a tight money spot? That would put serious stress on even the best relationship.

If you want to avoid feeling this way, it is important to recognize that emotions will flare up when investing, and to have an investment strategy in place that you can follow, despite these emotions.

Had I stuck to my investing strategy I could’ve avoided the losses and feeling this way.

In my excitement and desire to buy stocks I ignored obvious red flags when I should have just been patient and waited for a different investment opportunity that actually met all of the criteria.

Warren Buffett said it best …

“The stock market is a device for transferring money from the impatient to the patient.”

In this case, I was the impatient, transferring money to the patient investor. Don’t be like me!

Summary

The last and probably most important lesson I learned in this 5-part series covering the “8 Lessons I Learned from One of My Worst Dividend Growth Investments” was …

Lesson 8: Know Yourself, Make A Plan and Be Patient

Investors will always have an inner-conflict between their emotional responses to risk-taking and sticking to a rational investment strategy.

It’s important to know yourself and how you’ll react in certain situations so that you don’t let emotions get the best of you.

Having an investment plan that sets out clear criteria for when you should buy or sell a stock is an important step in removing emotions from a decision that should be made rationally.

Having the patience to do nothing until the right time is an under-appreciated investing skill and one that I regularly struggle with.

The Other Lessons

They say the hardest lessons in life are learned through experience. A 38.6% loss in about a month is a lot of “experience”, and that means a lot of lessons.

In fact, too many for just one article, so you’ll have to check out the other 4 articles in this 5-part series for the rest of the lessons.

- Lesson 1 & 2: Maintaining an “Investment Grade” Credit Rating Matters & Financial Strength Should Never Be Overlooked

- Lesson 3 & 4: Don’t Trust Management If the Numbers Don’t Make Sense & Never Ignore the Payout Ratio

- Lesson 5: When the Dividend Yield Gets Really High, It’s A Warning Sign That A Dividend Cut May Be Coming.

- Lesson 6 & 7: Diversification & Asset Allocation Matter & Don’t Forget Income Allocation Too!

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

Don’t be to hard on yourself. I think you have to go through such an experience to really learn from it.

Thanks for this series lessons, very informative.

I’ve felt your pain more than once as a trader. Now that I have switched to being a dividend-growth investor I am learning to keep my finger off the “BUY” button until I fully investigate a stock! Thanks again for another great article. I think postings like the ones you do inspire people to follow a sound and logical path to investing. Keep up the great work!