Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

Each month I update readers of all the dividend increases in the Canadian Dividend All-Star List (Canadian companies that have increased their dividend for 5 or more years in a row.) along with a summary of these companies.

Tracking recent dividend increases can be a good way to generate new dividend growth stock ideas as dividend increases can be a sign from management that they feel good about the future.

“the board of directors […] raised the dividend by 10% and thereby signaled their assessment of the company’s fundamental strength and outlook. Unlike earnings or guidance, a dividend can’t be faked.”

Source: Daniel Peris, The Strategic Dividend Investor (AL), Chapter 5

This month there were 10 dividend increases with the largest increase coming from Sylogist Ltd. (SYZ.V) at 18.8%.

November 2018 Dividend Increases in the Canadian Dividend All-Star List

Table of Contents – You can use the links below to jump ahead to the company you are interested in.

- Sylogist Ltd. (SYZ.V) – 18.8% Dividend Increase

- Magellan Aerospace Corporation (MAL.TO) – 17.6% Dividend Increase

- Canadian Tire Corp Ltd (CTC-A.TO) – 15.3% Dividend Increase

- Tecsys Inc. (TCS.TO) – 10.0% Dividend Increase

- InterRent Real Estate Investment Trust (IIP-UN.TO) – 7.4% Dividend Increase

- George Weston Ltd (WN.TO) – 5.1% Dividend Increase (2nd increase this year)

- Telus Corporation (T.TO) – 3.8% Dividend Increase (2nd increase this year)

- Equitable Group Inc (EQB.TO) – 3.7% Dividend Increase (3rd increase in last 12 months)

- Boyd Group Income Fund (BYD-UN.TO) – 2.3% Dividend Increase

- Inter Pipeline (IPL.TO) – 1.8% Dividend Increase

What is the Canadian Dividend All-Star List (CDASL)?

The CDASL is an excel spreadsheet with a lot of stock information that is typically used as a starting point to identify and screen Canadian dividend growth stocks. The list has been updated monthly since early 2013 and it has come to be one of the most popular resources of my website.

Download CDASL

Subscribe to the Dividend Growth Investing & Retirement newsletter and you'll be emailed the download link for the most recent version of the Canadian Dividend All-Star List (CDASL).

OK, now on to the dividend increases…

1. Sylogist Ltd. (SYZ.V) – 18.8% Dividend Increase

Sylogist is a small cap software company that has no long-term debt. They provide enterprise resource planning (“ERP”) solutions, including fund accounting, grant management and payroll to public service organizations. Sylogist’s public service customers include Local Governments, Non-Profit Organizations (“NPO”), Non-Governmental Organizations (“NGO”), Education Boards and Districts and Defense and Safety Contractors.

The Company currently has over 1,000 customers worldwide that range in size and operational complexity. The vast majority of the Company’s customers are in USA and Canada and the remainder in “UK and other” (which encompasses Latin America, Lebanon, Africa and Europe). Most of Sylogist’s customers are on annual contracts, which automatically renew. Given the nature of the Company’s product offering and the importance to its customers, the average customer life is more than 10 years.

Sylogist Dividends

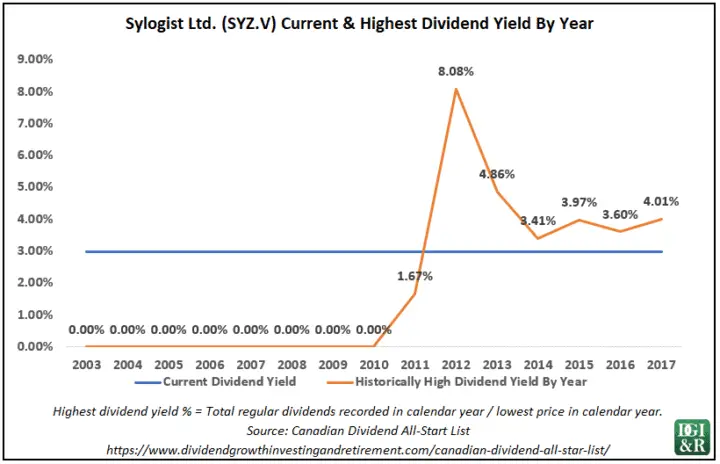

Sylogist Ltd. which has a dividend streak of 7 years recently increased their quarterly dividend 18.8% from $0.0800 CAD to $0.0950 CAD. This dividend increase comes into effect with the dividend recorded on Nov 30, 2018. The dividend yield as of December 7, 2018, was 3.0%, and they have a 5-year average annual dividend growth rate of 16.5%.

Sylogist has been around since March of 1993 but didn’t start paying dividends until 2011. They’ve been increasing each year since then.

For a smaller company like this, it might be prudent to wait for a 10-year streak before investing. If you are interested now, I’d wait for a higher dividend yield of around 4% as this is more in line with its historical highs.

Sylogist Financial Strength

The company doesn’t have any credit ratings, but that isn’t an issue because the company has no long-term debt. With no long-term debt, I’d say they have very good financial strength.

Sylogist Final Thoughts

Generally, I like to see a 10-year dividend streak before investing and for a smaller company like Sylogist, I think it could be prudent.

Sometimes smaller companies will cut their dividend even when it appears safe. It is usually to do with a large expansion where they need the additional funding or a change in their capital allocation strategy. I’m not saying this will happen with Sylogist, but in general, smaller companies have more flexible capital allocation policies so I’m a bit more cautious with them.

Sylogist is a fast-growing company, with no debt and good dividend growth metrics, but I’d try for a higher dividend yield of around 4% if you are considering them. I plan to wait and see if the dividend streak makes it to 10 years and then dig further into my analysis to determine if they have a sustainable competitive advantage or not.

[Back to Table of Contents] [Jump to Summary]

2. Magellan Aerospace Corporation (MAL.TO) – 17.6% Dividend Increase

Magellan is a diversified supplier of components to the aerospace industry with two major product groupings; aerostructures and aeroengines, which are used in new aircrafts and for spares and replacement parts. Magellan operates internationally, but primarily sells in Canada, the US, and Europe.

They design, engineer, and manufacture aeroengine and aerostructure components for aerospace markets, advanced products for defence and space markets, and complementary specialty products. Their two largest customers were Boeing and Airbus which accounted for 41.6% of total sales in 2017.

Magellan Aerospace Dividends

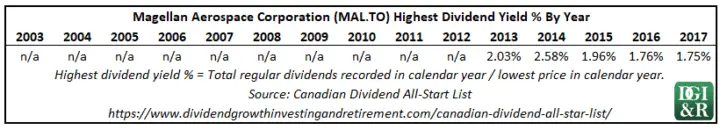

Magellan Aerospace Corporation which has a dividend streak of 5 years recently increased their quarterly dividend 17.6% from $0.0850 CAD to $0.1000 CAD. This dividend increase comes into effect with the dividend recorded on Dec 14, 2018. The dividend yield as of December 7, 2018, was 2.6%.

Magellan only started paying dividends in 2013, so I’d like to see a longer dividend streak before I consider investing.

Magellan Aerospace Final Thoughts

The short dividend history and the fact that the yield is low makes this company a pass for me. Since the dividend was initiated in 2013 the yield has never been above 3%. I prefer to invest in higher yielding companies with good dividend growth. So far, Magellan has been a low yield high dividend growth stock.

[Back to Table of Contents] [Jump to Summary]

3. Canadian Tire Corp Ltd (CTC-A.TO) – 15.3% Dividend Increase

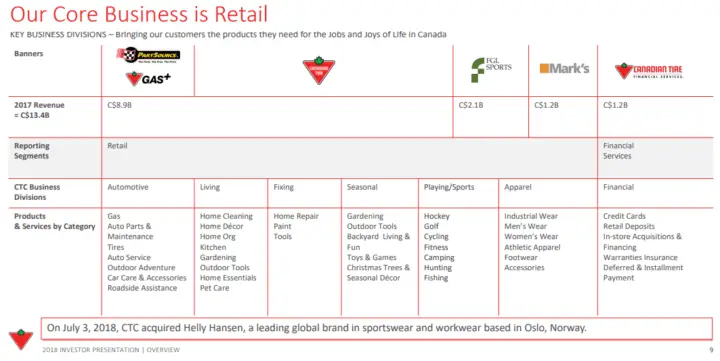

Canadian Tire has been in business for over 95 years and operates a leading portfolio of retail banners in Canada, including Canadian Tire, Sport Chek, Sports Experts, National Sports, Pro Hockey Life, Atmosphere, Mark’s, PartSource and Gas+.

Source: October 16, 2018 Investor Presentation

Canadian Tire Dividends

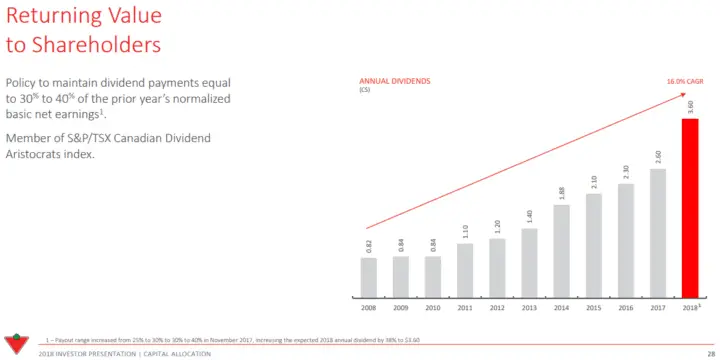

Canadian Tire which has a dividend streak of 7 years recently increased their quarterly dividend 15.3% from $0.9000 CAD to $1.0375 CAD. This dividend increase comes into effect with the dividend recorded on Jan 31, 2019. The dividend yield as of December 7, 2018, was 2.9%, and they have 5 and 10-year average annual dividend growth rates of 16.7% and 13.7% respectively.

Source: October 16, 2018 Investor Presentation

Canadian Tire Dividend Policy

“Canadian Tire’s policy is to maintain dividend payments equal to approximately 30% to 40% of the prior year’s normalized earnings, after giving consideration to the period-end cash position, future cash requirements, capital market conditions and investment opportunities. Normalized earnings for this purpose excludes gains and losses on the sale of credit card and loans receivable and non-recurring items but includes gains and losses on the ordinary course disposition of property and equipment.”

Source: https://corp.canadiantire.ca/English/investors/investor-resources/faqs/default.aspx

Canadian Tire Future Dividend Growth

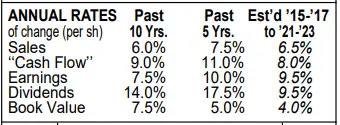

Canadian Tire has a good history of dividend growth, and Value Line thinks this trend will continue with 9.5% annual dividend growth over the next 3-5 years.

Source: October 26, 2018 Value Line Report

Related articles: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks & How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]

Canadian Tire Financial Strength & Valuation

The financial strength looks fine with Value Line giving Canadian Tire an “A” financial strength rating and the credit agencies giving BBB+ or equivalent.

Source: Canadian Tire Website: Investors > Debtholders > Credit Ratings

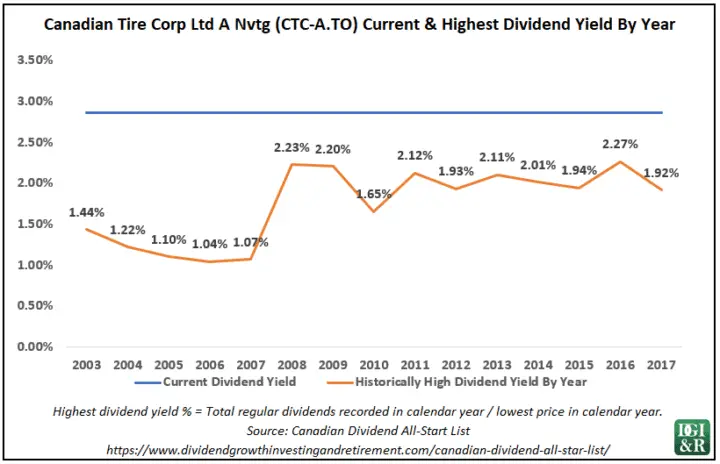

If you look at dividend yield only it looks like Canadian Tire is cheap as the current dividend yield of 2.9% is higher than it has been for the past decade.

Using the dividend yield to value a stock can be useful, but it is typically less reliable with stocks that are traditionally low yield stocks like Canadian Tire. In general, it is better to use more than one valuation metric as it paints a better overall picture.

Morningstar rates them a no-moat stock with a 3-star valuation as they are currently trading around their fair value estimate of $144.

TIP – Check to see if your broker provides access to Morningstar. I use Questrade (AL) which has free access to Morningstar research.

Canadian Tire Final Thoughts

Canadian Tire has a history of strong dividend growth and decent financial strength, but it is not a stock I’m interested in owning because it doesn’t have an economic moat and the yield is too low.

Retail is a hard industry to survive in long-term as it is largely cyclical and reliant on the economy so it’s not always a good fit for a dividend growth strategy. That said, Canadian Tire was able to keep their dividend steady throughout the 2008/2009 global financial crisis and it has a low payout ratio of around 30% so it can probably handle another challenging economic time should one come up.

I prefer to invest in high yield (4%+) companies and because the payout ratio is kept low I don’t expect Canadian Tire to get close to the 4% I’m looking for.

If Canadian Tire gets to a 10-year dividend streak and has a yield of around 4% or higher I’ll re-evaluate at that point.

[Back to Table of Contents] [Jump to Summary]

4. Tecsys Inc. (TCS.TO) – 10.0% Dividend Increase

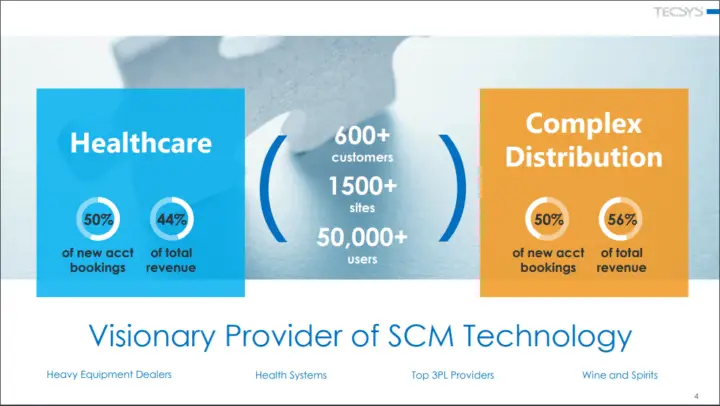

TECSYS is a leading provider of warehouse management software, distribution management software, and transportation management software, as well as complete financial management and analytics. The Company’s customers include mid-size and Fortune 1000 corporations in healthcare, third-party logistics and high-volume distribution industries such as import-to-retail, industrial distribution, and service parts.

Source: Investor Presentation Q2 2019 (*SCM = Supply Chain Management)

Competitors to TECSYS include SAP AG, Oracle Corporation, Manhattan Associates, Inc., JDA Software Group, Inc., HighJump Software Inc., Infor Inc., Softeon, Inc., Microsoft Corporation, Cardinal Health, Inc., Par Excellence Systems, Inc. and Omnicell, Inc.

Tecsys Dividends

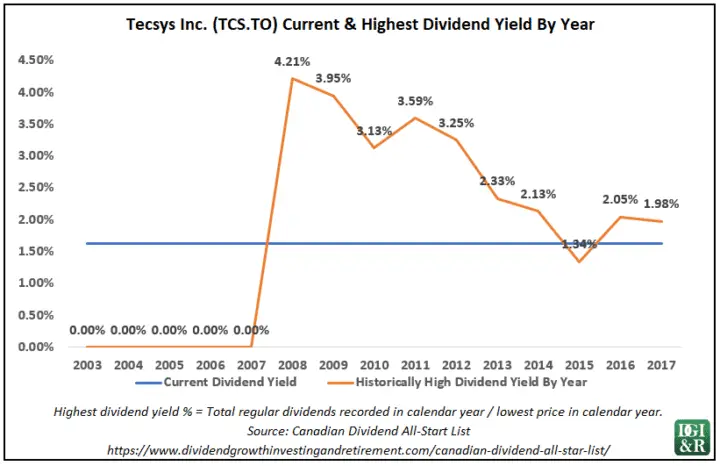

Tecsys Inc. which has a dividend streak of 10 years recently increased their quarterly dividend 10.0% from $0.0500 CAD to $0.0550 CAD. This dividend increase comes into effect with the dividend recorded on Dec 21, 2018. The dividend yield as of December 7, 2018, was 1.6%, and they have a 5-year average annual dividend growth rate of 23.3%.

Tecsys Final Thoughts

The company has good dividend growth metrics, but the current dividend yield is too low for me to be interested right now.

[Back to Table of Contents] [Jump to Summary]

5. InterRent Real Estate Investment Trust (IIP-UN.TO) – 7.4% Dividend Increase

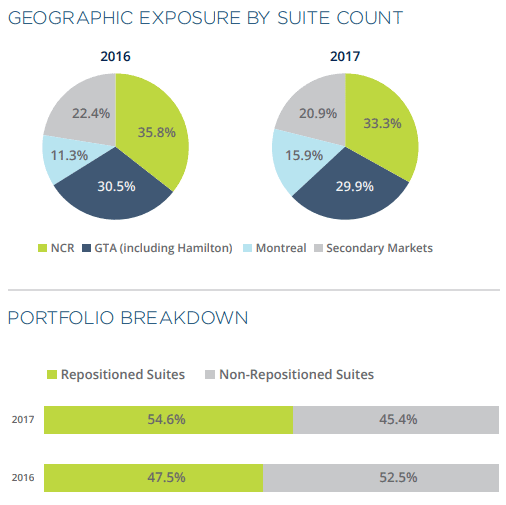

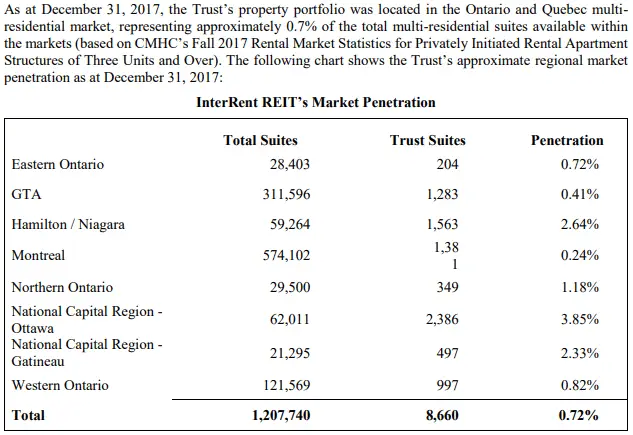

InterRent Real Estate Investment Trust has a diversified portfolio of multi-residential properties in Ontario and Quebec. As of December 31, 2017, the Trust’s portfolio was comprised of 72 Properties containing 8,660 suites with about 21% located in mid-sized population markets, and the remaining 79% located in the Greater Toronto Area (GTA) (including Hamilton), Montreal and the National Capital Region (NCR).

Source: 2017 Annual Report

Source: 2017 Annual Information Form

InterRent REIT’s core strategy is expanding the portfolio with a focus on larger markets (the GTA (including Hamilton), NCR and Montreal) and on properties that require some level of re-positioning.

InterRent REIT Dividends/Distributions

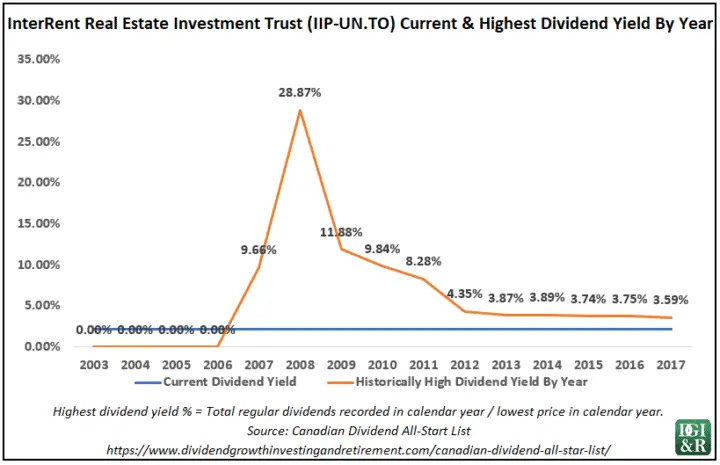

InterRent REIT which has a dividend streak of 6 years recently increased their monthly dividend 7.4% from $0.0225 CAD to $0.0242 CAD. This dividend increase comes into effect with the dividend recorded on Nov 30, 2018. The dividend yield as of December 7, 2018, was 2.2%, and they have 5 and 10-year average annual dividend growth rates of 12.6% and -3.4% respectively.

The 10-year dividend growth rate is negative because InterRent REIT began monthly distributions in March 2007 at $0.0317 per unit, but in May of 2008, they announced that the June 2008 distribution was being reduced to $0.0217 per unit. Then they announced another decrease in December 2008, with the January 2009 monthly distribution dropping to $0.01 per unit.

InterRent REIT Final Thoughts

I expect REITs to have high yields, but InterRent REIT is around 2.2% which is too low for me to be interested. They also have two dividend cuts in their past and the dividend streak is less than 10 years so I’m not interested in them.

[Back to Table of Contents] [Jump to Summary]

6. George Weston Ltd (WN.TO) – 5.1% Dividend Increase

George Weston Ltd owns almost half of Loblaw Companies Limited (L.TO); which has the largest network of grocery stores and pharmacies in Canada. Their investment in Loblaws contributes to the vast majority of their sales, but they also have a Weston Foods division. This division produces a variety of fresh, frozen and specialty bakery products including breads, rolls, bagels, tortillas, donuts, cakes, pies, cookies, crackers and other baked goods in North America.

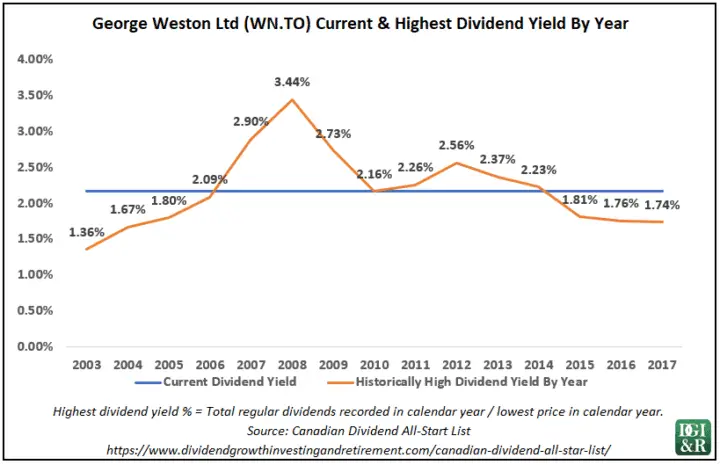

George Weston Dividends

George Weston Ltd which has a dividend streak of 6 years recently increased their quarterly dividend 5.1% from $0.4900 CAD to $0.5150 CAD. This dividend increase comes into effect with the dividend recorded on Dec 15, 2018.

This was the 2nd increase this year. If you factor in both increases then the annual increase was 13.2% ($0.4550 quarterly dividend to $0.4900 announced in May 2018 and then most recently to $0.5150).

The dividend yield as of December 7, 2018, was 2.2%, and they have 5 and 10-year average annual dividend growth rates of 4.3% and 2.3% respectively.

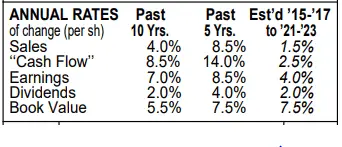

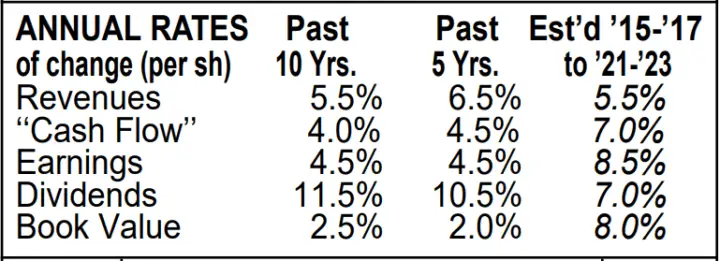

While the company has had two dividend increases this year, Value Line is estimating low future dividend growth of 2% over the next 3-5 years which is more in-line with its 5 and 10-year dividend growth rates.

Source: George Weston Value Line Report October 19, 2018

Related articles: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks & How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]

George Weston Financial Strength & Valuation

George Weston has a financial strength rating from Value Line of B++ and credit ratings of BBB from S&P and DBRS. This is a little too low for me.

FYI – I typically look for a B+ rating or higher from Value Line and from the credit rating agencies a BBB+/BBB (high)/Baa1 rating or higher.

Based on dividend yield the stock is around fair value or moderately attractive as the current yield is a bit higher than it has been in recent years, but still under most years from 2007 to 2014.

Morningstar rates them a no-moat stock with a four-star valuation as they are currently trading under their fair value estimate of $117.

TIP – Check to see if your broker provides access to Morningstar. I use Questrade (AL) which has free access to Morningstar research.

George Weston Final Thoughts

Despite the 2nd dividend increase this year I’m not interested. The company doesn’t have a moat, the dividend streak is less than 10 years and the credit ratings are a bit too low (BBB when I want BBB+ or higher). The dividend yield is low too at 2.2% and Value Line is estimating low future dividend growth of only 2%.

[Back to Table of Contents] [Jump to Summary]

7. Telus Corporation (T.TO) – 3.8% Dividend Increase

Telus provides phone, internet, and television services and is one of the three largest telecom companies in Canada.

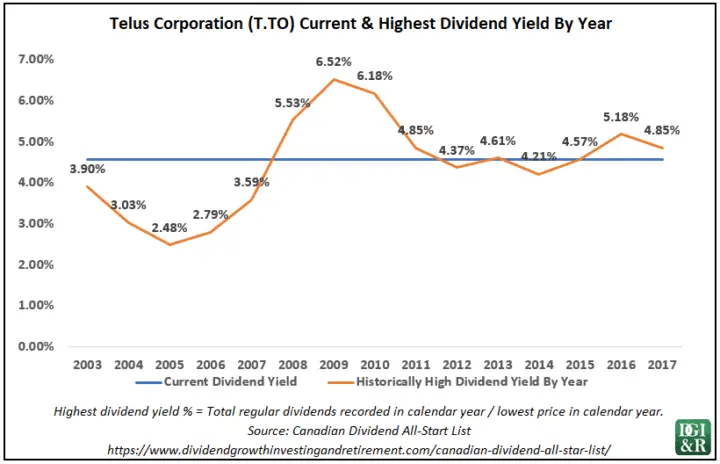

Telus Dividends

Telus Corporation which has a dividend streak of 14 years recently increased their quarterly dividend 3.8% from $0.5250 CAD to $0.5450 CAD. This dividend increase comes into effect with the dividend recorded on Dec 11, 2018. The dividend yield as of December 7, 2018, was 4.6%, and they have 5 and 10-year average annual dividend growth rates of 10.1% and 9.6% respectively.

Telus has been increasing their dividend twice a year, so if you factor in both increases, then the annual increase was 7.9% ($0.5050 quarterly dividend to $0.5250 and then most recently to $0.5450).

Telus Dividend Policy

Telus typically raises their dividend twice a year and is targeting annual dividend increases in the range of 7 to 10% from 2017 through to the end of 2019. Their long-term dividend payout ratio guideline is 65 to 75 percent of prospective net earnings.

Telus Future Dividend Growth

Analysts are estimating around $3 per share in earnings over the next 12 months which would put their payout ratio a little over 70% which is in-line with their guideline of 65 to 75 percent of prospective net earnings.

The problem I’m having is that their payout ratio guideline is a bit on the high side in general. Typically, I like to see a 60% or less payout ratio but will go up to 70% for utilities where the cash flow is a bit more predictable. I think I’d be OK with a payout ratio around 70% for Telus, but I’d want a bit higher of yield, say +5% because I expect the dividend growth to slow over the long term.

Telus has good historical dividend growth rates with 5 and 10-year averages around 10%, but it has come with an increasing payout ratio. Over the next 5 to 10 years I’d expect lower dividend growth say in the 5-7% range.

Value Line is estimating future dividend growth of 7% over the next 3-5 years.

Source: September 14, 2018 Telus Value Line Report

Related articles: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks & How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]

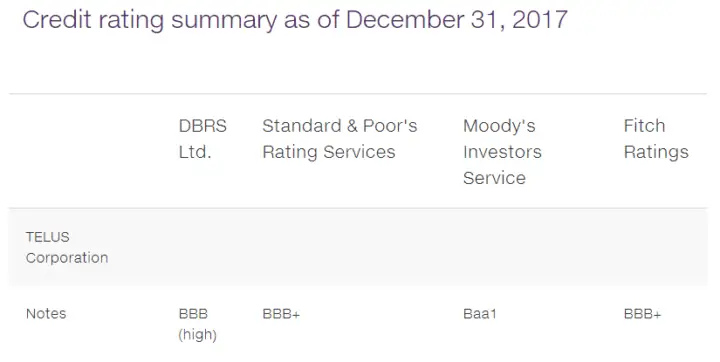

Telus Financial Strength & Valuation

Telus has a financial strength rating from Value Line of B++ and credit ratings of BBB+ or equivalent from the rating agencies.

Source: https://www.telus.com/en/about/investor-relations/investor-services/bondholder-services

I typically look for a B+ rating or higher from Value Line and from the credit rating agencies a BBB+/BBB (high)/Baa1 rating or higher. Telus meets all of these requirements.

Based on dividend yield the stock looks moderately attractive as the current yield is right around its historic highs. You could’ve done a bit better in 2008 and 2009, but this can be said for most companies.

Morningstar rates them a narrow moat stock with a three-star valuation as they are currently trading around their fair value estimate of $49.

TIP – Check to see if your broker provides access to Morningstar. I use Questrade (AL) which has free access to Morningstar research.

Telus Final Thoughts

Telus has been on my radar for a while now as they have consistently posted the largest dividend increases compared to the other Canadian telecom companies. Somehow, I never pulled the trigger.

Telus hits most of my requirements, but I’d like to see the price come down a bit more before I get interested. With an improvement in valuation, I’d be looking for a +5% dividend yield before I start to look into Telus more.

Normally, I’m looking for 4% dividend yield or higher, but with Telus, I think their future dividend growth will be around 5-7% over the next 5 or 10 years. I want a bit higher of a starting yield to compensate for the lower dividend growth.

Because they have a high payout ratio based on earnings (Around 70%ish), I’d also want to look at their cash flow situation more in-depth before I invested.

[Back to Table of Contents] [Jump to Summary]

8. Equitable Group Inc (EQB.TO) – 3.7% Dividend Increase

Equitable Group Inc operates through its subsidiary Equitable Bank which is a branchless Canadian bank that offers residential lending, commercial lending and savings solutions. Their residential mortgages are to customers who have the financial resources to achieve real estate ownership but don’t qualify for a mortgage in the prime market. This includes self-employed borrowers, new Canadians, and the credit challenged.

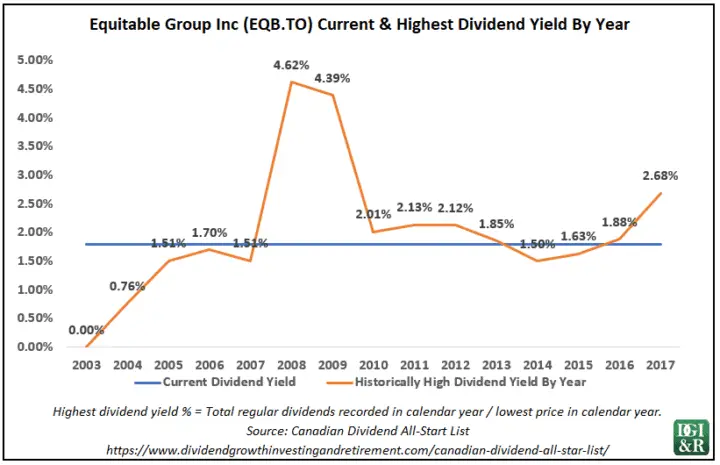

Equitable Group Inc Dividends

Equitable Group Inc which has a dividend streak of 7 years recently increased their quarterly dividend 3.7% from $0.2700 CAD to $0.2800 CAD. This dividend increase comes into effect with the dividend recorded on Dec 14, 2018. The dividend yield as of December 7, 2018, was 1.8%, and they have 5 and 10-year average annual dividend growth rates of 12.8% and 9.0% respectively.

In the past few years, Equitable Group has been increasing their quarterly dividend multiple times each year. A year ago (Record date December 15, 2017) the dividend was $0.25, then they increased it 3 times over the next four dividend announcements with this most recent increase resulting in a $0.28 quarterly dividend.

If you factor in the three increases, then the annual increase was 12% ($0.25 to $0.26, then to $0.27, and with this latest announcement to $0.28).

Equitable Group Financial Strength & Historical Dividend Yield

DBRS gives the company a credit rating of BBB (low) which is two notches below the BBB+ or equivalent I typically like to see.

The current dividend yield of 1.8% is low compared to some of its historical highs.

Equitable Group Inc Final Thoughts

This is not a stock I’m interested in as the credit rating is too low at BBB (low). On top of that my portfolio already has enough financials currently.

Yes, the dividend growth has been strong recently, but the yield is low. If you are looking to add Canadian financials start with the Big 5 banks first, before you start to look at other companies in this sector. I feel like the big banks give you a better mix of high dividend yield and decent dividend growth prospects, plus they are in a much better financial position (Higher credit ratings) than Equitable Group.

Disclosure: I don’t own the stock Equitable Group Inc, but I do bank with EQ Bank.

[Back to Table of Contents] [Jump to Summary]

9. Boyd Group Income Fund (BYD-UN.TO) – 2.3% Dividend Increase

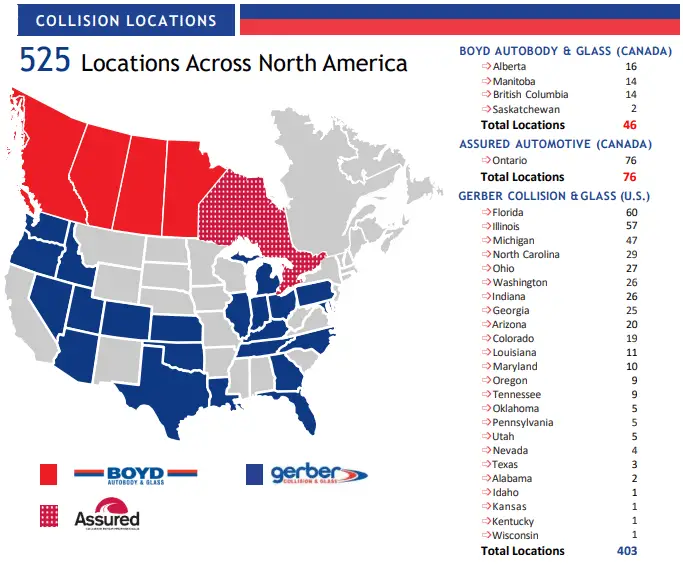

Boyd Group Income Fund is an unincorporated, open-ended mutual fund trust that holds a majority interest in The Boyd Group Inc. The Boyd Group Inc. is one of the largest operators of non-franchised collision repair centers in North America in terms of number of locations and sales.

The Company operates locations in five Canadian provinces under the trade names Boyd Autobody & Glass and Assured Automotive, as well as in 24 U.S. states under the trade name Gerber Collision & Glass.

Source: Boyd Group Income Fund Q2 2018 Fact Sheet

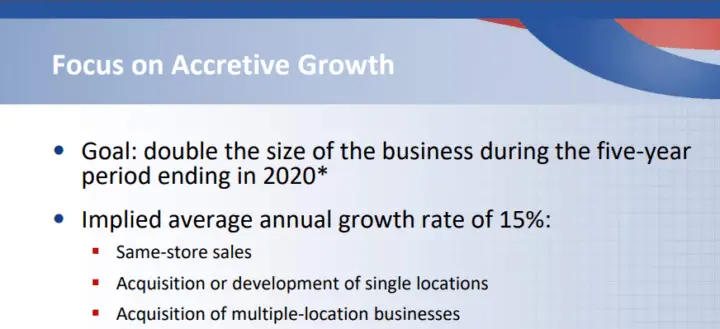

Boyd intends to grow its business by increasing same-store sales and the opening or acquiring of new locations.

Source: Investor Presentation September 2018

Boyd is fast growing from its acquisition strategy and its stock has performed very well in the past, but this hasn’t translated into recent high dividend growth because the payout is kept low to fund the aggressive growth strategy.

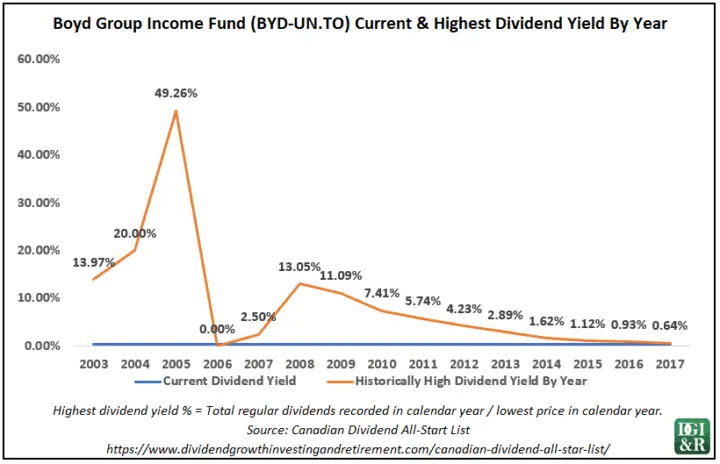

Boyd Group Income Fund Dividends

Boyd Group Income Fund which has a dividend streak of 11 years recently increased their monthly dividend 2.3% from $0.0440 CAD to $0.0450 CAD. This dividend increase comes into effect with the dividend recorded on Nov 30, 2018. The dividend yield as of December 7, 2018, was 0.5%, and they have 5 and 10-year average annual dividend growth rates of 2.7% and 33.0% respectively.

You’ll notice that they cut the dividend in the past which is why there aren’t any dividends in 2006.

Boyd Group Income Fund Final Thoughts

Boyd has seen very good stock returns, but the low recent dividend growth and the low yield make the company a pass for me. My dividend growth strategy involves primarily investing in higher yielding dividend growth stocks and Boyd’s yield is under 1% so it’s not really on my radar.

[Back to Table of Contents] [Jump to Summary]

10. Inter Pipeline (IPL.TO) – 1.8% Dividend Increase

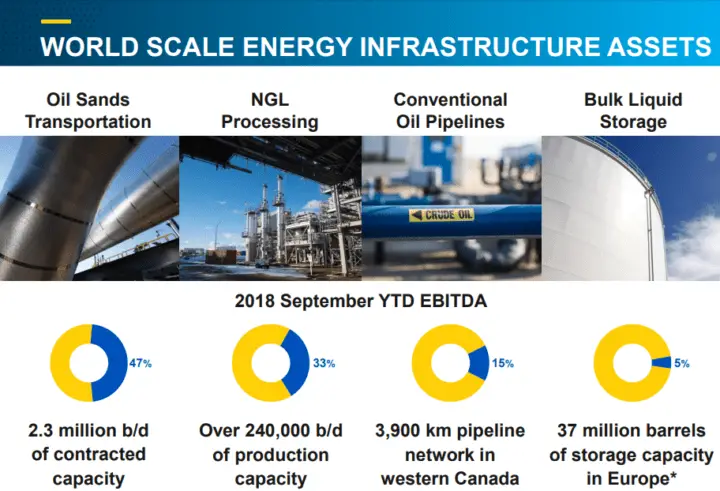

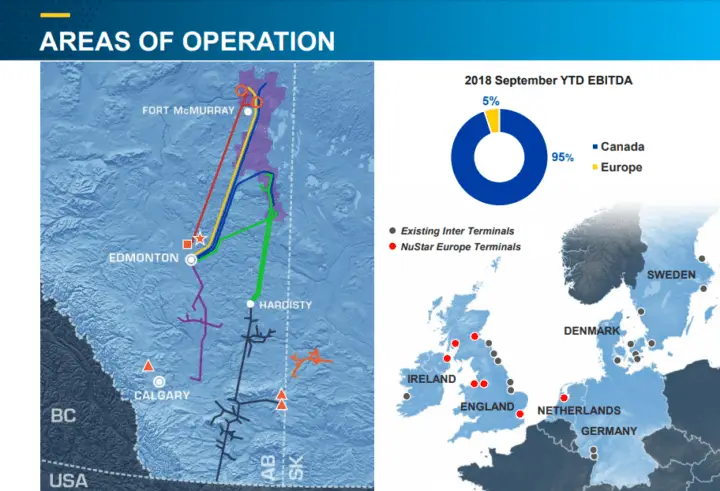

Inter Pipeline is a major petroleum transportation, natural gas liquids processing, and bulk liquid storage business based in Calgary, Alberta, Canada.

Source: November 2018 Corporate Presentation

Inter Pipeline owns and operates energy infrastructure assets in western Canada and Europe.

Source: November 2018 Corporate Presentation

Inter Pipeline Dividends

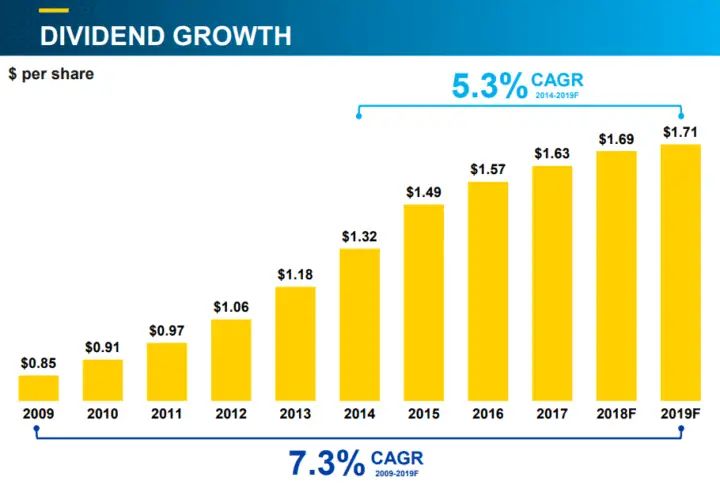

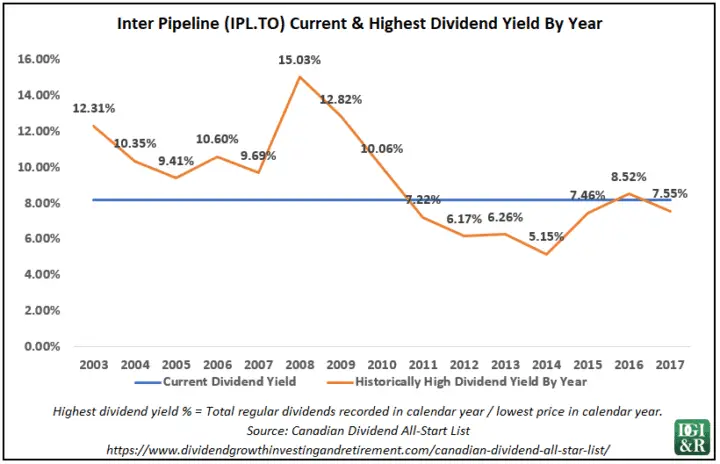

Inter Pipeline which has a dividend streak of 9 years recently increased their monthly dividend 1.8% from $0.1400 CAD to $0.1425 CAD. This dividend increase comes into effect with the dividend recorded on Nov 22, 2018. The dividend yield as of December 7, 2018, was 8.2%, and they have 5 and 10-year average annual dividend growth rates of 9.1% and 6.9% respectively.

Source: November 2018 Corporate Presentation

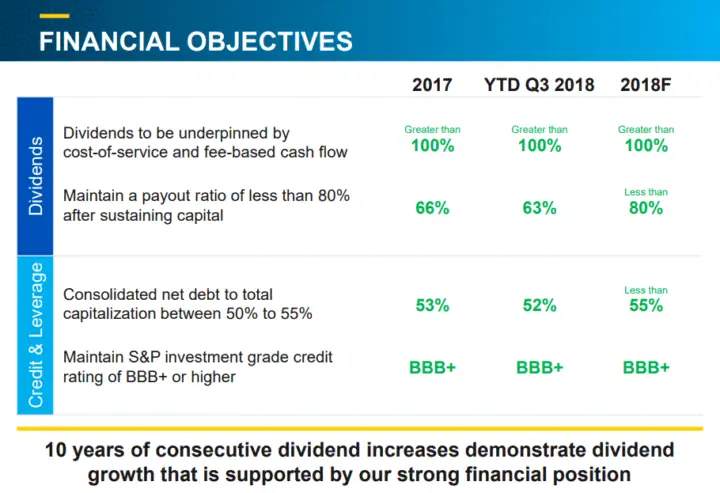

Inter Pipeline Financial Strength & Valuation

Inter Pipeline has credit ratings of BBB+ (negative outlook) from S&P and BBB from DBRS.

Source: November 2018 Corporate Presentation

I typically look for a BBB+/BBB (high)/Baa1 rating or higher, so the DBRS rating is too low for me.

The current yield of 8.2% is around its recent (2011 and on) historical highs.

Morningstar rates them a no-moat stock with a three-star valuation as they are currently trading around their fair value estimate of $25.

TIP – Check to see if your broker provides access to Morningstar. I use Questrade (AL) which has free access to Morningstar research.

Inter Pipeline Final Thoughts

The high yield may be tempting, but the recent low dividend increase doesn’t send a very good signal. They don’t have an economic moat and the credit rating from DBRS is one notch too low for me at BBB. This isn’t a stock I’m interested in.

Summary

Monitoring dividend increases is a good idea because it can be a sign from management that they feel good about the future prospects of the company.

There were 10 November 2018 dividend increases in the Canadian Dividend All-Star List (An excel spreadsheet with a lot of stock information on all Canadian companies that have increased their dividend for 5 or more calendar years in a row.):

- Sylogist Ltd. (SYZ.V) – 18.8% Dividend Increase

- Magellan Aerospace Corporation (MAL.TO) – 17.6% Dividend Increase

- Canadian Tire Corp Ltd (CTC-A.TO) – 15.3% Dividend Increase

- Tecsys Inc. (TCS.TO) – 10.0% Dividend Increase

- InterRent Real Estate Investment Trust (IIP-UN.TO) – 7.4% Dividend Increase

- George Weston Ltd (WN.TO) – 5.1% Dividend Increase

- Telus Corporation (T.TO) – 3.8% Dividend Increase

- Equitable Group Inc (EQB.TO) – 3.7% Dividend Increase

- Boyd Group Income Fund (BYD-UN.TO) – 2.3% Dividend Increase

- Inter Pipeline (IPL.TO) – 1.8% Dividend Increase

Of these 10 companies, the one that interests me the most is Telus, but I’d like to see a bit more of a price drop so that the yield is around 5% before I’d consider investing.

Sylogist Ltd. is another company that interests me because they have no long-term debt, but I still need to do some work in order to determine if they have a sustainable competitive advantage or not.

Disclosure: You can see my portfolio here.

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

Excellent report, and a valuable guideline for investors. Keep it up. Doug

Thanks Doug!

Hey there,

Nice post to understand dividend growth of canadian.

The information you have posted is very useful. The sites you have referred was good. Thanks for sharing…

I appreciate the work you’re putting in to share these companies with all of us. It makes things easier for beginner investors and not just them. I think this kind of analysis should be used more often and not just in the stock market but with in any other market (for bonds, cryptocurrencies, forex, etc).