Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

I missed February and March, but normally each month I update readers of all the dividend increases in the Canadian Dividend All-Star List (Canadian companies that have increased their dividend for 5 or more years in a row.) along with a summary of these companies.

Tracking recent dividend increases can be a good way to generate new dividend growth stock ideas as dividend increases can be a sign from management that they feel good about the future.

“The managers and directors of large corporations know, far better than anyone else, the financial condition of their companies and the directions that future earnings will take. Directors of the nation’s most responsible blue-chip companies are not going to pay or increase a dividend unless the payout is fiscally justified and sound.”

Source: Geraldine Weiss/Janet Lowe, Dividends Don’t Lie (AL), Chapter 1

This month there were 3 dividend increases with the largest increase coming from Imperial Oil (TSE:IMO) at 15.8%.

April 2019 Dividend Increases in the Canadian Dividend All-Star List

Table of Contents – You can use the links below to jump ahead to the company you are interested in.

- Imperial Oil (IMO.TO) – 15.8% Dividend Increase

- Open Text Corporation (OTEX.TO) – 15.0% Dividend Increase

- Loblaw Companies Limited (L.TO) – 6.8% Dividend Increase

What is the Canadian Dividend All-Star List (CDASL)?

The CDASL is an excel spreadsheet with a lot of stock information that is typically used as a starting point to identify and screen Canadian dividend growth stocks. The list has been updated monthly since early 2013 and it has come to be one of the most popular resources of my website.

Download CDASL

Subscribe to the Dividend Growth Investing & Retirement newsletter and you'll be emailed the download link for the most recent version of the Canadian Dividend All-Star List (CDASL).

OK, now on to the dividend increases…

Imperial Oil (IMO.TO) – 15.8% Dividend Increase

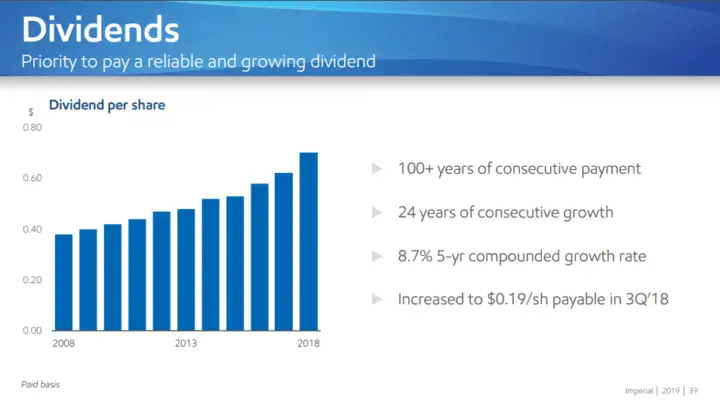

Imperial Oil is the 2nd largest integrated oil company in Canada, the largest refiner of petroleum products in Canada and has an impressive dividend history. Imperial Oil paid its first dividend to shareholders in 1891 and hasn’t missed one since. They are 69.6% owned by Exxon Mobil (NYSE:XOM).

Source: Winter/Spring 2019 Corporate Overview

Imperial Oil Dividends

Imperial Oil which has a dividend streak of 24 years recently increased their quarterly dividend 15.8% from $0.1900 CAD to $0.2200 CAD. This dividend increase comes into effect with the dividend recorded on Jun 03, 2019.

The dividend yield as of May 19, 2019, was 2.3%, and they have 5 and 10-year average annual dividend growth rates of 8.3% and 6.7% respectively.

Source: Winter/Spring 2019 Corporate Overview

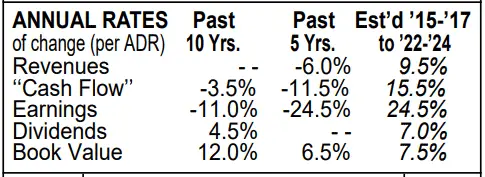

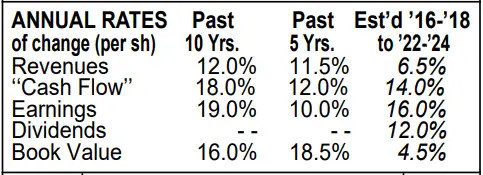

Value Line is estimating 7% annual dividend growth over the next 3-5 years. Please note that this is the Value Line report for the NYSE list Imperial Oil and not the TSE listing.

Source: Imperial Oil Ltd. (NYSE:IMO) March 1, 2019 Value Line Report

Related articles: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks & How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]

Imperial Oil Financial Strength & Valuation

Value Line gives Imperial Oil an “A” rating for financial strength and they have an AA credit rating from DBRS and an AA+ (negative outlook) credit rating from S&P which are all above the BBB+ or equivalent I typically like to see. Imperial Oil’s financial strength is good.

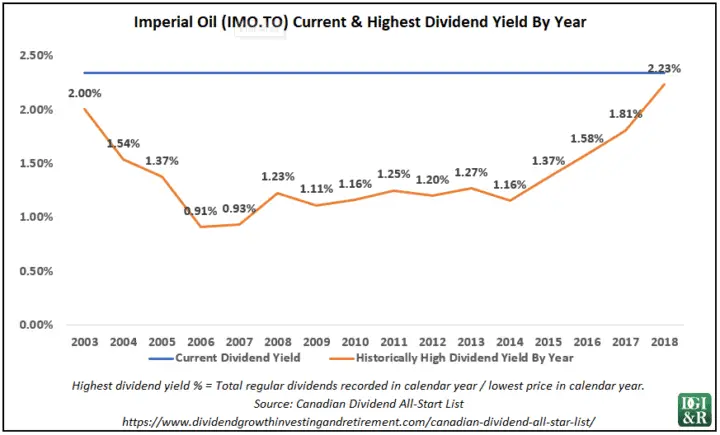

Looking at the past 15 years shows that Imperial Oil is typically a low yielding stock. It’s current yield of 2.3% while low is historically high for the company.

Normally when the current dividend yield is above previous historic highs it suggests that the stock is under-valued. Please keep in mind that when you use dividend yield as a valuation tool for lower yielding companies it is usually less reliable. This is why it’s good practice to look at a variety of different valuation metrics.

Morningstar rates them a no-moat stock with a three-star valuation as they are currently trading around or a bit below the fair value estimate of $45 CAD. Imperial Oil’s stock price as of May 19, 2019 is $37.61 and Morningstar’s five-star price is $27.

TIP – Check to see if your broker provides access to Morningstar. I use Questrade (AL) which has free access to Morningstar research.

Imperial Oil Final Thoughts

Imperial Oil has good credit ratings, a long dividend history and the recent dividend increase of almost 16% is a good sign, but Imperial Oil’s yield is just too low for me to be interested. Plus, I already own Exxon Mobil which owns almost 70% of Imperial Oil.

Disclosure: I own shares of Exxon Mobil (NYSE:XOM)

[Back to Table of Contents] [Jump to Summary]

Open Text Corporation (OTEX.TO) – 15.0% Dividend Increase

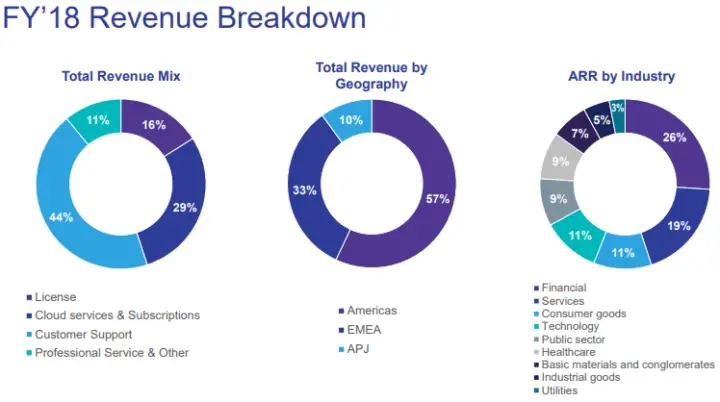

Open Text operates in the Enterprise Information Management (EIM) market and develops enterprise software for digital transformation. At its core, EIM is about helping organizations get the most out of information. Open Text’s EIM offerings include Content Services, Business Process Management, Customer Experience Management, Discovery, Business Network, and Analytics.

Source: May 1, 2019 Investor Presentation

Open Text Dividends

Open Text Corporation which has a dividend streak of 6 years recently increased its quarterly dividend 15.0% from $0.1518 USD to $0.1746 USD. This dividend increase comes into effect with the dividend recorded on May 31, 2019.

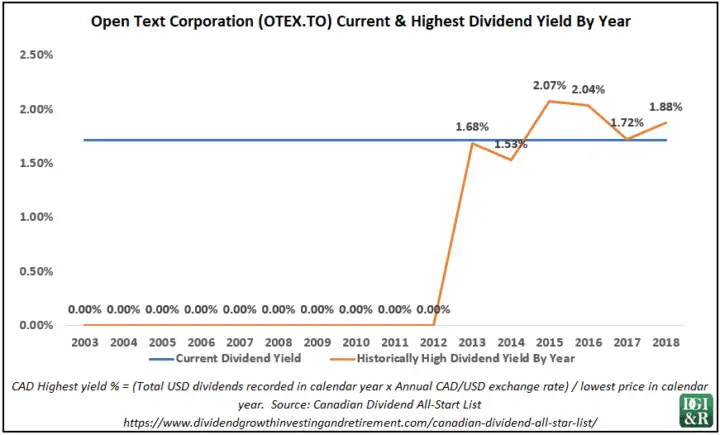

The dividend yield as of May 19, 2019, was 1.7%, and they have a 5-year average annual dividend growth rate of 21.2%.

Value Line is estimating 12% annual dividend growth over the next 3-5 years and 16% earnings growth. Please note that the Value Line report is for the US Nasdaq listed OTEX, not the Toronto Stock Exchange OTEX.

Source: Open Text (NASDAQ:OTEX) April 12, 2019 Value Line Report

Related articles: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks & How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]

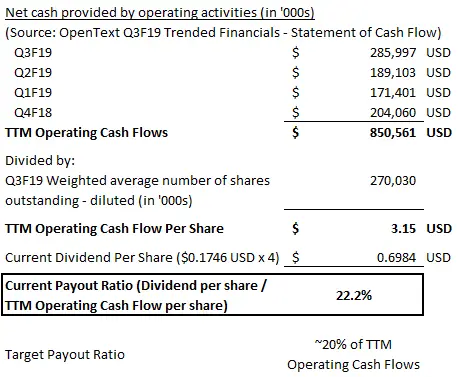

Open Text Target Dividend Payout Ratio

According to Open Text’s May 1, 2019 Investor Presentation their target dividend payout ratio is approximately 20% of trailing twelve months (TTM) operating cash flows.

By my calculations (see below), they are currently at 22%, so future dividend growth should be roughly in line with operating cash flow growth assuming the target payout ratio stays the same.

Value Line is estimating 14% annual cash flow growth over the next 3-5 years so if Open Text is able to meet these estimates then the dividend will probably grow at low to mid double digits (10-15%).

Open Text Financial Strength & Highest Dividend Yield

Value Line gives Open Text Corp a “B++” rating for financial strength and they have a BB+ credit rating from S&P and a Ba1 credit rating from Moody’s. The credit ratings are below the BBB+ or equivalent I typically like to see.

Open Text started paying a dividend in 2013 and since that time the yield has been low. The current yield of 1.7% is too low for me to be interested right now.

Open Text Final Thoughts

I was initially attracted to Open Text’s high growth rates, but ultimately, it’s not a company I plan to invest in as:

- The credit ratings are too low,

- The dividend yield is low, and

- It has a short dividend history having only started paying dividends in 2013.

[Back to Table of Contents] [Jump to Summary]

Loblaw Companies Limited (L.TO) – 6.8% Dividend Increase

Loblaw Companies Limited provides grocery, pharmacy, health and beauty, apparel, general merchandise, banking, and wireless mobile products and services. They have the largest network of grocery stores and pharmacies in Canada including Loblaws, Zehrs, Superstore, No Frills, Shoppers Drug Mart, and others.

They have several private-label food brands like President’s Choice and No Name. In addition, they have an apparel brand Joe Fresh, provide financial services through PC Financial and are the majority unitholder of Choice Properties Real Estate Investment Trust.

Loblaw Dividends

Loblaw Companies Limited which has a dividend streak of 7 years recently increased their quarterly dividend 6.8% from $0.2950 CAD to $0.3150 CAD. This dividend increase comes into effect with the dividend recorded on Jun 15, 2019.

The dividend yield as of May 19, 2019, was 1.8%, and they have 5 and 10-year average annual dividend growth rates of 4.2% and 3.2% respectively.

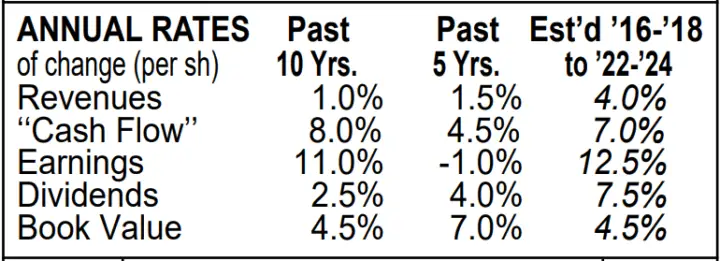

Value Line is estimating 7.5% annual dividend growth over the next 3-5 years and 12.5% earnings growth.

Source: Loblaws (TSE:L) April 19, 2019 Value Line Report

Related articles: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks & How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]

Loblaw Financial Strength & Valuation

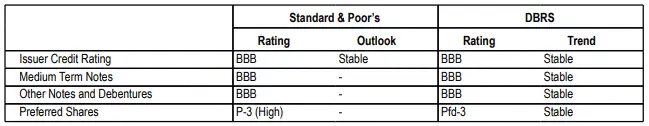

Value Line gives Loblaw’s a “B++” rating for financial strength and they have BBB credit ratings from DBRS and S&P. The credit ratings are below the BBB+ or equivalent I typically like to see.

Source: 2018 Annual Information Form

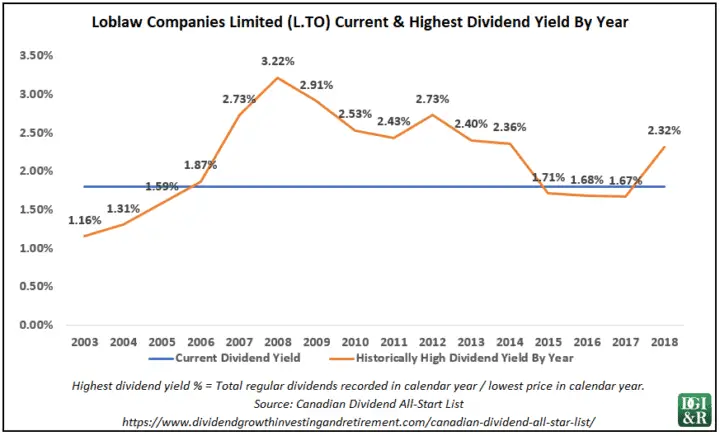

Loblaw’s current dividend yield of 1.6% is on the low side, suggesting that the stock is over-valued. That said, when you use dividend yield as a valuation tool for lower yielding companies it is usually less reliable. This is why it’s good practice to look at a variety of different valuation metrics.

Morningstar rates them a no-moat stock with a two-star valuation as they are currently trading above Morningstar’s fair value estimate of $58 CAD.

TIP – Check to see if your broker provides access to Morningstar. I use Questrade (AL) which has free access to Morningstar research.

Loblaw Final Thoughts

This isn’t a company I’m interested in as the credit ratings are too low and they don’t have a moat despite being the largest traditional grocer in Canada.

In addition, the dividend yield is low, and the 5-and 10-year dividend growth rates are low. The recent 6.8% dividend increase and Value Line’s 7.5% future annual dividend growth estimate could be a sign that dividend growth will be improving for Loblaw’s but this isn’t enough to interest me.

Summary

Monitoring dividend increases is a good idea because it can be a sign from management that they feel good about the future prospects of the company.

There were 3 April 2019 dividend increases in the Canadian Dividend All-Star List (An excel spreadsheet with a lot of stock information on all Canadian companies that have increased their dividend for 5 or more calendar years in a row.):

- Imperial Oil (IMO.TO) – 15.8% Dividend Increase

- Open Text Corporation (OTEX.TO) – 15.0% Dividend Increase

- Loblaw Companies Limited (L.TO) – 6.8% Dividend Increase

None of these three are really on my radar as all of them currently have low dividend yields.

If I were forced to pick, I’d only consider Imperial Oil, but the yield would have to increase substantially before I’d be seriously interested. I already own Exxon Mobil which owns almost 70% of Imperial Oil, so I doubt that I’ll ever actually own Imperial Oil.

Open Text is an interesting company because future dividend growth is expected to be high, but its financial strength is just too low for me to consider it further right now. Open Text uses a growth by acquisition strategy, which has been working well for them, but with credit ratings below investment grade, it’s too risky for me.

What are your thoughts on these 3 companies?

Disclosure: I own shares of Exxon Mobil (NYSE:XOM). You can see my portfolio here.

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

Missed your monthly summary the last couple months. Good to see you back at it!

Any chance of reviewing and catching up the missing months? Good, useful information as always. Thanks.

I might try some sort of catch up article. Was there a specific company you wanted reviewed?