Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

Want to double your dividend income in 10 years?

Invest in dividend growth stocks that average +7% dividend growth per year.

Want to triple your dividend income in 10 years?

Add in dividend reinvestment with a reasonably high starting dividend yield.

A portfolio yielding 5% with +7%/year dividend growth will roughly triple its dividend income after 10 years if dividends are reinvested.

Before we get into the compounding powers of dividend reinvestment, let’s look at a “double your dividend income” example.

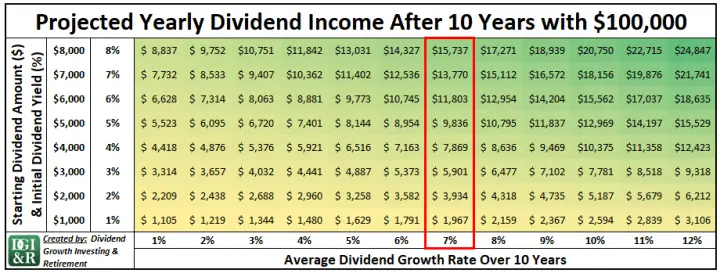

How to double your dividend income with $100,000

Let’s say you have $100,000 and you invest it in dividend growth stocks that initially yield 4%.

To start, your annual dividend income is expected to be $4,000 ($100,000 x 4%).

Over the next 10 years, dividends in your portfolio grow at 7%/year on average.

Your dividends grow from the initial $4,000/year to $7,869/year after a decade.

Ok, so 7% dividend growth doesn’t quite double in 10 years, but you get close.

You’d actually need an average of 7.2%/year dividend growth to double your dividend income in 10 years.

Using the same $100,000 portfolio example with a 4% yield and 7.2%/year dividend growth would mean projected dividends of $8,017/year after 10 years.

Bottom line

At 7% average dividend growth, projected dividends will almost double after 10 years.

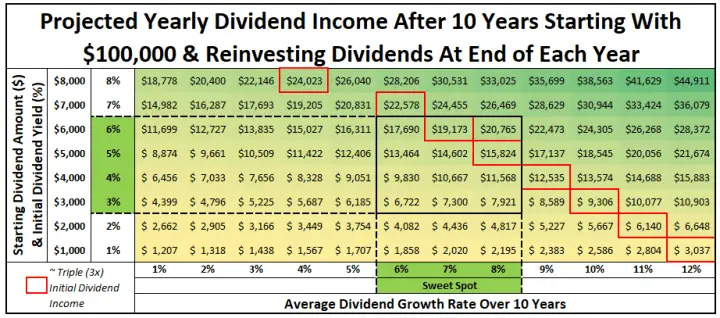

From the table above you can see that regardless of your starting yield, projected dividends almost double after 10 years so long as the dividend growth is 7%.

A $100,000 portfolio that has a 2% yield starts with $2,000/year in dividend income and grows to $3,934 after 10 years with 7% dividend growth.

An initial yield of 6% starts with $6,000/year and grows to $11,803 over 10 years.

And so on and so on…

So if you want to double your dividends in 10 years, make sure your dividend growth is over 7%.

Sounds simple enough, but it’s harder in practice if you want a reasonable starting yield.

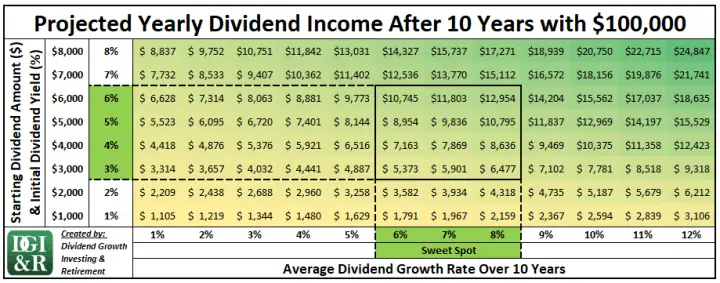

The Sweet Spot: 3-6% Dividend Yield With 6-8% Dividend Growth

I’ve found the sweet spot is a yield in the 3-6% range with 6-8% dividend growth.

Low Yield (<3%) = Not enough dividend income even with high dividend growth

If the yield is too low (<3%), then dividend income even after a decade of high dividend growth is still too low to live off of.

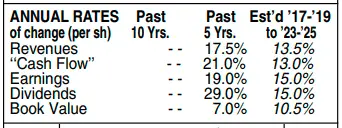

Visa (NYSE:V) Example

For example, I’m pretty sure Visa (NYSE:V) will be able to grow dividends at a high rate over the next 10 years, but its yield is really low.

As I write this, the yield is only 0.6% and Value Line is estimating 15%/year dividend growth over the next 3-5 years.

Source: Visa Value Line Annual Rates Table November 6, 2020

Let’s say you invest $100,000 in Visa and it grows its dividend at 15%/year for the next decade.

In 10 years’ time, your projected annual dividends will have grown from the initial $600/year to $2,427.

In other words, over 10 years the yield on cost had grown from the very low 0.6% to the still low 2.4%. For most retirees, this low income isn’t going to be enough.

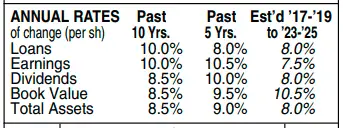

Toronto-Dominion Bank (TSE:TD; NYSE:TD) Example

Compare this with Toronto-Dominion Bank (TSE:TD; NYSE:TD) which at the time of writing yields 4.5% and Value Line is estimating 8% dividend growth per year for the next 3-5 years.

Source: Toronto-Dominion Bank Value Line Annual Rates Table November 6, 2020

If TD manages to grow its dividend by 8%/year over the next 10 years your projected dividends on a $100,000 investment will have grown from $4,500/year to $9,715.

Even though Visa had a much higher dividend growth rate, TD’s dividend income after 10 years is still 4 times that of Visa’s.

Remember, these are just examples to illustrate a point, please don’t go out and buy $100,000 of just one stock.

The idea is to build a diversified portfolio with dividend growth stocks that fall within the sweet spot of 3-6% yield with 6-8% dividend growth.

High Yield (>6%) = Risk of Dividend Cuts & Unreliable Dividend Safety

If the starting yield is too high (>6%), then it’s a sign the company might cut the dividend or future dividend growth will be low.

There can be exceptions to this of course, but if you are looking for reliable dividend income in retirement, don’t go yield chasing.

You don’t want to be worrying about the dividend safety of your investments if the plan is to live off that dividend income.

The Sweet Spot: Not too hot, not too cold, just right …

I want a mix of high, but not too high yield and reasonably high dividend growth.

My sweet spot for dividend growth is 6-8% because it’s a reasonably attainable goal for stocks yielding 3-6%.

Sometimes you’ll be able to find stocks with higher yields and dividend growth rates, but just make sure the dividend is safe.

After all, there is no free lunch in finance.

Ultimately there is a trade-off between dividend yield and dividend growth.

- Most high dividend growth (+10%) stocks have very low yields.

- Most stocks with high dividend yields have very low or no dividend growth, and some will cut their dividend.

My sweet spot is all about finding safe and reliable dividend growth stocks with the right balance of dividend yield and dividend growth.

Hopefully, these examples and this table can help you find your own sweet spot as you plan out your retirement.

How to Triple your Dividend Income with Dividend Reinvestment

I mentioned at the beginning of the post that a portfolio yielding 5% with +7%/year dividend growth will roughly triple its dividend income after 10 years if dividends are reinvested.

Well, it’s not the only way to do it.

In the table below I’ve highlighted in red the different dividend yields and growth rates you’d need to triple your projected dividend income after a decade.

5% Yield, 8% Dividend Growth & Dividend Reinvestment Example

Step #1: You invest $100,000 in dividend growth stocks that yield 5% and grow dividends at 8%/year.

Step #2: You reinvest dividends at the end of each year back into more 5% yield, 8% dividend growth companies.

Step #3: Wait 10 years.

Results: After 10 years, you will have more than tripled your initial $5,000 in dividends. In fact, at the end of 10 years, your portfolio will pay out $15,824 in dividends.

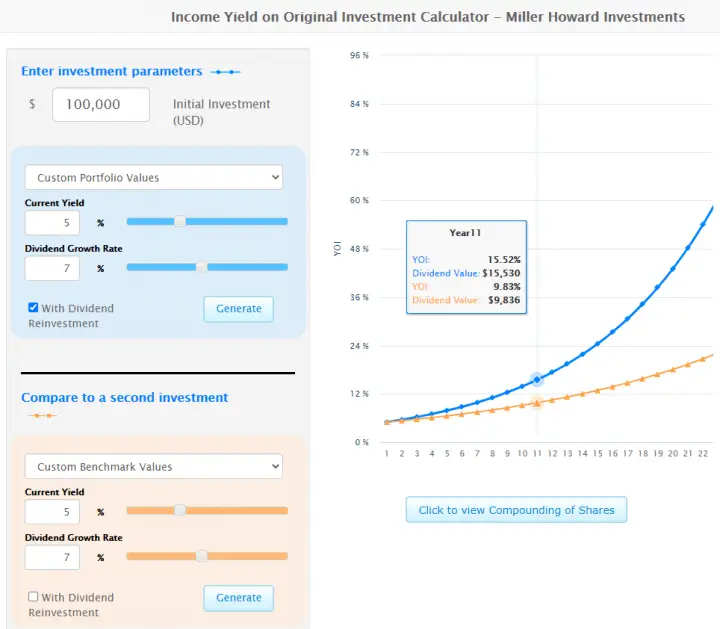

A Useful Tool: The Income Yield on Original Investment Calculator

While researching for this article, I stumbled across the “Income Yield on Original Investment Calculator” from Miller Howard Investments.

I hope that you find the tables in this article useful, but if you are looking for something more interactive you should use the “Income Yield on Original Investment Calculator“

5% Yield & 7% Dividend Growth: With & Without Dividend Reinvestment

Here’s a screenshot of what $100,000 with 5% yield and 7% dividend growth looks like:

- without dividend reinvestment = orange line, and

- with dividend reinvestment = blue line.

Source: Miller Howard Investments “Income Yield on Original Investment Calculator“

In the chart above you see that at the end of year 10 (Shows as the beginning of Year 11 in this tool):

- Dividend income without dividend reinvestment would be $9,836 (orange line), which is almost double the $5,000 dividend income you start with.

- Dividend income with dividend reinvestment would be $15,530 (blue line), which is more than triple the $5,000 dividend income you start with.

I noticed that my dividend reinvestment tables don’t exactly match the tool above, but I think it’s because in my tables I’m reinvesting the dividends once a year and in the “Income Yield on Original Investment Calculator” I think they reinvest every quarter (4 times a year).

Summary

Want to double your dividend income in 10 years?

Invest in dividend growth stocks that average 7.2% dividend growth per year.

Use this table to see what the dividend income on $100,000 will grow to in 10 years’ time depending on the initial yield and dividend growth rate.

Want to triple your dividend income in 10 years?

Add in dividend reinvestment with a reasonably high starting dividend yield.

The boxes highlighted in red show you what dividend yield and dividend growth rate you’d need to triple your income after 10 years.

Hopefully, you find these tables useful as you plan out your retirement, but remember to focus on the sweet spot of 3-6% dividend yield and 6-8% dividend growth.

Too high of a yield and your risk of dividend cuts increases and too low of a yield and it won’t be enough to live off of in retirement.

My sweet spot is all about finding safe and reliable dividend growth stocks with the right balance of dividend yield and dividend growth.

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

Hi DGI&R, I think you are getting a little too technical for most people, this is a good report for geeks.

Hope you and your family have a Great Christmas and New Years, best wishes Grumpybear

Fair enough, but I have to put something out for the geeks like me every now and again 😉

I wanted it to be a way to showcase the power of dividend growth and reinvestment over time while also giving readers some tools on how they could use this info to plan for their own retirement. Sounds like I might’ve missed the mark a bit by going too technical.

Merry Christmas and a happy new year’s to you too!

You have done an excellent job showing how two simple parameters, dividend and DGR, have a profound effect even over the medium term. I am over eighty, and am fully invested in such stocks, plus a good proportion of US ETFs and one or two US stocks. It has taken me 25 years to reach this comfortable strategy: I only wish had had twigged this at the beginning! Great work!

Thanks Doug!

Great article. Just signed up for DSR following your advice. Mike recommends many VERY low yield stocks in his sample portfolios. (ie: ATD.B at 0.8% and MG.TO at 2.66%). How do you feel about these? He stands by them because their growth is decent, but what are your thoughts? ATD.B isn’t close to your sweet spot at all!

Ultimately it depends on your investment goals.

If you look at the total return for ATD.B then most investors would be quite happy, but I wrote this article with a 50ish year old in mind that is about 10 years away from retirement and their main objective is building a reliable dividend income stream to supplement their retirement income.

I’m ok with having some low yield, very high dividend growth stocks in my portfolio, but overall I’m trying to land in the sweet spot for my whole portfolio yield and growth.

My investment style is probably more similar to DSR’s retirement sample portfolios than some of their others.

Cheers,

DGI&R

You need to separate your strategy between accumulation and retirement income. You technically need income only when you are retired and living from the income. In the accumulation years, “total” growth is what matters which is stock + dividend together. In which case the yield is not important. The growth is what you need to focus on.

Last year, I thought about starting to switching my portfolio to income over the next 5 year only to realize I can do that in 1 quarter. I opted to focus on high dividend growth (which means low yield) and made adjustments.

DGI&R is correct in how the math works, but you technically get to the same place just by buying in the last year. What the company pays on year 10 is the same for new and existing investors so you get the same dollars.

Many thanks for your efforts, much appreciated and enjoyed the read.

Your material is extremely well researched and presented. I have been investing since 1978 and have used many components of what you have presented. However, my utilization did not always consider a more combined approach to long and longer term investing.

Your material is easy to understand. Although I have a BSc and two graduate degrees, anyone with at least Grade 3 mathematics should be able to comprehend your presentations.

I hope that you continue your excellent and well presented work.

Mark Turnbull

Thanks for the kind words Mark!

Cheers,

DGI&R

I think you are bang on on picking a retirement stock. I arrived at the same conclusion. The dividend growth has to keep up with inflation 🙂

I have been trying to highlight the stages of a portfolio between “accumulation” and “income” as many investors seem to invest for “income” in their 30s and leave a lot of money on the table. I made that mistake for 4 years between 2009 and 2013 and once I switched to dividend growth, I saw a significant growth in my portfolio value.

This is a great article! I recently put together an Excel spreadsheet to look at the yield on cost for different initial dividend yields, dividend growth rates and time horizons. The only comment I can add is that stocks with lower initial dividend yields and higher dividend growth rates are beneficial for younger investors and those in retirement that do not need more dividend income. Stocks in your sweet region are perfect for the core of a portfolio at any age.

Pure Gold: “The Sweet Spot: 3-6% Dividend Yield With 6-8% Dividend Growth”. Using the Sweet Spot Strategy to buy a basket of stocks and hold on to these stocks will make one very happy if those chosen stocks stay on the Dividend Allstar List. The only time I would sell is if the stock got dropped from the Allstar List.

This is an absolutely fantastic article.

I really appreciate the effort that you put into educating those new to DIY investing such as myself. All of these dividend reinvestment growth calculations work great for TFSA and RRIF accounts where dividends are shielded from taxes. However for non-registered accounts I think you need to consider the after-tax dividend yield in these calculations, and this is determined by the dividend source. Eligible Canadian dividends are taxed at around 10% up to the 90k tax bracket whereas US dividends are taxed as ordinary income at around 30% in the same tax bracket. This shows a considerable advantage to Canadian versus US dividend growth stocks. This is the same effect that you see in the commonly-used ‘Growth of 10K projections’ on all investing platforms, but I never seem to see anyone talking about it. Any comments?

Hi Stuart,

Sorry, I don’t discuss tax issues on the blog.

Cheers,

DGI&R

Thank you Dividend Earner.

Just what I have been looking for as I research a methodology for my granddaughters TFSA.

I have been considering an S&P 500 method but more recently siding with a Canadian ETF account for dividend strategy. Want to keep simple for her. Any comments? $100 donation today. Thanks so much. Ron

Hi Ron,

Thanks for the donation, glad you like the article.

It’s anybody’s guess as far as if an US ETF will perform better than a Canadian ETF or vice-versa, and I don’t provide investment advice on the blog.

Generally, when someone is looking for a simple, set and forget type strategy a couch potato approach can be a good fit. Here’s a useful link from the Canadian Couch Potato blog: https://canadiancouchpotato.com/model-portfolios/

Ultimately when you think about what’s the best approach for you or your granddaughter my first question is usually related to what strategy do you think you’ll be able to stick with the best over the long-term? Before you even start thinking about what strategy you think will give you the best returns you need to consider which strategy you can actually stick with through thick and thin and then go from there. When the market crashes 40 or 50% are you going to panic sell, or stick with it? You need almost a religious belief in your strategy sometimes to get through those really difficult times otherwise you sell at the worst possible time and it doesn’t really matter what strategy you picked at the beginning anymore. This is, of course, is going to be different for everybody, but I’d start there. Hopefully, that made sense?

Cheers,

DGI&R

This was a highly useful post. This part hit me hard: “I’ve found the sweet spot is a yield in the 3-6% range with 6-8% dividend growth.” This seems like the perfect combination of long-term growth and yield for present day needs.